Iowa food stamps eligibility calculator, a tool of great import, opens the door to understanding the complexities of Iowa’s Food Assistance Program, formerly known as Food Stamps or SNAP. This guide will help to uncover the program’s purpose, the individuals it aims to serve, and the critical nuances of determining who qualifies for assistance in the Hawkeye State.

The Iowa Food Assistance Program (FAP) is designed to help low-income individuals and families afford nutritious food, boosting their well-being and supporting the local economy. It is crucial to grasp the official name and acronym to navigate the resources effectively. This detailed exploration delves into eligibility requirements, income and asset limits, work mandates, and the application process. It also covers income considerations, asset and resource evaluations, household composition impacts, and the process of maintaining eligibility.

The calculator serves as a crucial tool in this process.

Introduction to Iowa Food Assistance (Food Stamps)

Alright, buckle up, buttercups, because we’re diving into the world of Iowa Food Assistance, also known as Food Stamps, or, as the cool kids say, SNAP. This program is a safety net, a helping hand, and a lifeline for many Iowans. Think of it as a grocery store gift card provided by the government to help families and individuals put food on the table.

It’s all about ensuring that people have access to the nutrition they need to stay healthy and thrive.The Iowa Food Assistance Program (FAP) is the official name and acronym for the program in the Hawkeye State. It’s designed to provide assistance to low-income individuals and families, giving them the resources to buy groceries and combat food insecurity. The program helps those who may be struggling to make ends meet, whether due to job loss, low wages, disability, or other challenges.

Purpose of Iowa Food Assistance

The primary goal of the Iowa Food Assistance Program is to alleviate hunger and improve nutrition among low-income residents. It’s about providing a basic level of food security, ensuring that people don’t have to choose between paying rent and buying groceries. This program aims to support the health and well-being of vulnerable populations.The program also has broader societal benefits. By providing access to nutritious food, FAP can help reduce healthcare costs associated with malnutrition, improve children’s educational outcomes, and contribute to a more productive workforce.

It’s an investment in the community’s overall health and prosperity.

Who Iowa Food Assistance Aims to Help

The Iowa Food Assistance Program is designed to assist a wide range of individuals and families who meet certain eligibility requirements. This includes:

- Low-Income Families: Families with children who have limited financial resources are a primary target group. The program helps them provide nutritious meals for their kids. Imagine a single mom working two jobs, struggling to make ends meet. FAP can make a huge difference in her ability to feed her children healthy food.

- Individuals: Single adults with low incomes are also eligible. This could be someone recently unemployed, a person with a disability, or someone working a minimum-wage job.

- Elderly and Disabled Individuals: Seniors and individuals with disabilities often face higher living expenses and may have limited income. FAP can help them afford the food they need to maintain their health. Consider an elderly couple on a fixed income; food costs can quickly become a significant burden.

- Working Families: Even families with one or more working members may qualify if their income is below the eligibility threshold. The program recognizes that wages may not always be sufficient to cover basic needs. This can include a family where one parent works full-time, but the income still doesn’t cover all the expenses.

How the Program Works

The Iowa Food Assistance Program provides benefits through an Electronic Benefit Transfer (EBT) card. Think of it like a debit card that can be used to purchase eligible food items at authorized retailers. The amount of benefits a household receives depends on several factors, including income, household size, and certain expenses.

Benefit Amount Calculation:

The formula is based on the difference between a household’s net income and the maximum allowable income for the household size, considering standard deductions and other adjustments.

The program is administered by the Iowa Department of Health and Human Services (HHS). Individuals and families can apply for benefits through the Iowa HHS website or at their local county Department of Human Services office.

Understanding Eligibility Criteria in Iowa

Alright, let’s dive into the nitty-gritty of who gets to snag those sweet Food Assistance Program (FAP) benefits in the Hawkeye State. It’s not just a free-for-all; there are some hoops to jump through. Think of it like auditioning for a reality show – gotta meet the casting requirements! We’ll break down the essential stuff you need to know to see if you’re eligible for food stamps in Iowa.

General Eligibility Requirements in Iowa

To even be considered for Iowa FAP, you gotta play by the rules. It’s like being a resident of the state, but for food assistance.To be eligible, you must:

- Be an Iowa Resident: You gotta call Iowa home. This means you have to live in the state, with the intent to stay. Think of it like this: if your driver’s license and voter registration say “Iowa,” you’re probably good to go. Temporary visitors need not apply.

- Be a U.S. Citizen or Qualified Alien: You must be a U.S. citizen or a non-citizen who meets specific immigration status requirements.

- Meet Income and Asset Limits: This is where the real math comes in. We’ll get to the specifics of income and assets in a bit.

- Have a Social Security Number (SSN): This is a standard requirement for most government programs.

Income Limits for Different Household Sizes in Iowa

Okay, here’s the part where we talk numbers. The amount of money you can make (your income) determines if you’re eligible. The Iowa Department of Health and Human Services (HHS) sets these limits, and they change from time to time, so always check the official Iowa HHS website for the most up-to-date figures. Think of it like the price of concert tickets – it depends on the artist (household size) and the seat (income).The following table provides an example of income limits.

These numbers are illustrative and not guaranteed to be current. Always verify with the official Iowa HHS website.

| Household Size | Gross Monthly Income Limit | Net Monthly Income Limit |

|---|---|---|

| 1 | $1,500 | $1,150 |

| 2 | $2,000 | $1,500 |

| 3 | $2,500 | $1,900 |

| 4 | $3,000 | $2,300 |

Keep in mind:

- Gross Income: This is your income before taxes and deductions.

- Net Income: This is your income after certain deductions are taken out, like childcare costs or medical expenses for the elderly or disabled.

- These limits are subject to change: Always check the official Iowa HHS website.

Asset Limits Affecting Eligibility in Iowa

It’s not just about how much you earn; it’s also about what you own. The FAP program also considers your assets. Think of assets as your “stuff.”Asset limits are in place to ensure the program helps those with the greatest need. Generally, these limits are:

- For households with an elderly (age 60 or older) or disabled member: The asset limit may be higher.

- For all other households: The asset limit is lower.

Here’s what counts as an asset:

- Bank Accounts: Checking and savings accounts are included.

- Stocks and Bonds: Investments count.

- Real Estate (excluding your primary residence): If you own a vacation home or rental property, it’s considered an asset.

- Cash: Cold, hard cash is also considered.

Generally, your primary residence and one vehicle arenot* counted as assets. However, there are exceptions and specific rules, so always check with the Iowa HHS.

Work Requirements and Exemptions for FAP Recipients in Iowa

FAP isn’t just about getting help; it’s also about work, or at least the willingness to work. Most able-bodied adults without dependents (ABAWDs) are required to meet work requirements to continue receiving benefits. Think of it as a part-time job requirement.Here’s the deal:

- ABAWDs: Able-bodied adults without dependents are generally required to work or participate in a work program for a certain number of hours per week (usually 20 hours).

- Work Requirements can be Met Through: Employment, job training, or community service.

- Exemptions: There are exemptions to the work requirements, such as:

- Being medically certified as unfit for work.

- Caring for a child under age 6.

- Being pregnant.

- Being over a certain age (e.g., 50 or 60).

If you’re an ABAWD and don’t meet the work requirements, you may only be eligible for food assistance for a limited time (usually three months) within a 36-month period.

Do not overlook explore the latest data about sunny up food truck.

Categories of Individuals Who May Be Automatically Eligible in Iowa

Some people are already considered to be in a tough spot, and they’re automatically eligible for FAP. It’s like getting a fast pass at the theme park – no waiting in line!Examples include:

- Those receiving TANF (Temporary Assistance for Needy Families): If you’re already getting cash assistance through TANF, you’re likely automatically eligible for food stamps.

- Those receiving SSI (Supplemental Security Income): If you are receiving SSI, you are also likely automatically eligible.

- Certain Medicaid recipients: In some cases, if you’re enrolled in specific Medicaid programs, you may also be automatically eligible.

This is not an exhaustive list, and eligibility can vary. Always confirm with the Iowa HHS.

Utilizing the Iowa Food Stamps Eligibility Calculator

So, you’ve heard about Iowa Food Assistance (that’s Food Stamps to you and me) and you’re wondering if you qualify? Awesome! The Iowa Food Stamps eligibility calculator is your digital sidekick in this quest. Think of it as a super-smart quiz that helps you figure out if you’re eligible for SNAP benefits. It’s like a personalized eligibility check, taking into account your specific financial situation.

What the Iowa Food Stamps Eligibility Calculator Is and Its Function

The Iowa Food Stamps eligibility calculator is a free, online tool designed to estimate your potential eligibility for the Supplemental Nutrition Assistance Program (SNAP) in Iowa. It’s a screening tool, not the final say, but it provides a good initial assessment. Its function is to quickly assess your financial situation against SNAP guidelines. It’s designed to be user-friendly, breaking down complex eligibility rules into simple questions.

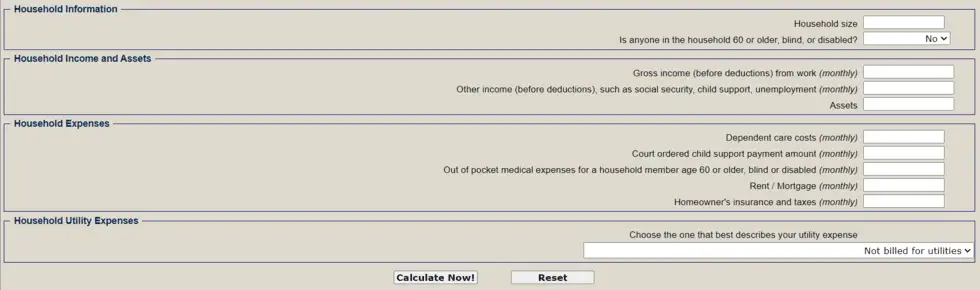

Step-by-Step Guide on How to Use an Online Iowa FAP Eligibility Calculator

Using the online Iowa FAP eligibility calculator is pretty straightforward. It’s designed to be user-friendly.

- Find a Reputable Calculator: Search online for “Iowa SNAP eligibility calculator” or “Iowa food stamps calculator.” Make sure you’re using a calculator from a trusted source, like the Iowa Department of Health and Human Services (if available) or a reputable non-profit organization.

- Start the Process: Click the “Start” or “Begin” button. You’ll likely be asked to agree to terms of use or privacy policies.

- Enter Household Information: The calculator will ask about your household. This includes the number of people you live with who share meals and expenses.

- Provide Income Details: You’ll be prompted to enter information about your income. This is a critical step, and we’ll dive into the specifics later.

- Input Expenses: The calculator will then ask about your household expenses, such as rent or mortgage payments, utilities, and any medical expenses.

- Review Your Results: Once you’ve entered all the necessary information, the calculator will provide an estimated eligibility determination. It will tell you if you’re likely eligible, potentially eligible, or not eligible. It’s important to remember this is just an estimate.

- Follow Up: If the calculator indicates potential eligibility, it’s time to apply for SNAP benefits. The calculator will often provide links or instructions on how to proceed.

How to Input Different Types of Income into the Calculator

Income is a major factor in SNAP eligibility. The calculator needs accurate income information to provide a reliable estimate. Let’s break down how to input different income sources:

- Wages from a Job: This is the most common type of income. You’ll need to provide your gross monthly income, meaning the amount you earn before taxes and other deductions. Your pay stubs are your best friend here.

- Self-Employment Income: If you’re self-employed, calculating your income is a bit different. You’ll need to subtract your business expenses from your gross earnings to determine your net self-employment income. The calculator will usually have a section for this.

- Unemployment Benefits: Unemployment benefits are considered income. You’ll need to provide the amount of your weekly benefit and how often you receive it (e.g., weekly, bi-weekly).

- Social Security Benefits: If you receive Social Security, including retirement, disability, or survivor benefits, you’ll need to enter the gross monthly amount.

- Other Income: Be prepared to report any other sources of income, such as child support payments, alimony, pensions, or investment income. Be honest and thorough, as this information impacts the accuracy of the results.

For example, let’s say you work at a local diner and earn $15 per hour. You work 40 hours per week. Your gross weekly income is $600 ($15 x 40). To calculate your monthly gross income, multiply that by 4.333 (the average number of weeks in a month): $600 x 4.333 = $2,599.80.

How to Input Household Expenses into the Calculator

Household expenses can significantly impact your eligibility for SNAP. The calculator considers certain expenses to determine your net income, which is used to assess eligibility.

- Housing Costs: This includes rent or mortgage payments. You’ll need to enter the amount you pay each month.

- Utilities: Include the costs of utilities such as electricity, gas, water, and sewer. The calculator might ask for an average monthly amount.

- Medical Expenses: If you or someone in your household has significant medical expenses, you can deduct the portion of those expenses that exceed $35 per month. This can include doctor visits, prescription medications, and health insurance premiums.

- Childcare Costs: If you pay for childcare so you can work or attend school, you can deduct these expenses.

- Other Deductible Expenses: The calculator might allow for deductions for other expenses, such as legally obligated child support payments.

Imagine a scenario where you pay $800 in rent, $200 in utilities, and $150 in medical expenses per month. After calculating your medical expense deduction, the calculator will use these figures to determine your net income.

Common Errors Users Might Make When Using the Calculator and How to Avoid Them

Even with a user-friendly tool, mistakes can happen. Here’s how to avoid common errors:

- Incorrect Income Amounts: The biggest mistake is often providing inaccurate income information. Double-check your pay stubs, bank statements, and any other documentation to ensure you’re entering the correct amounts. Always use gross income (before taxes) for wages.

- Forgetting Expenses: Don’t forget to include all eligible expenses. Missing expenses can lead to an inaccurate eligibility estimate.

- Not Reading Instructions Carefully: The calculator’s instructions are there for a reason. Take the time to read them carefully to avoid misunderstandings.

- Using an Unofficial Calculator: Only use calculators from reputable sources, such as the Iowa Department of Health and Human Services (if available) or a trusted non-profit.

- Assuming the Results are Final: The calculator provides an estimate. It is not a guarantee of eligibility. You still need to apply for SNAP and go through the official verification process.

For instance, a common mistake is mixing up gross and net income. If you accidentally enter your net income instead of your gross income, the calculator will likely overestimate your eligibility.

Income Considerations for FAP in Iowa

Alright, let’s break down how your bank account – or lack thereof – plays a role in getting those Iowa Food Assistance benefits. Think of it like a financial reality check. The state needs to know what’s coming in to figure out what kind of help you need. It’s all about ensuring the program goes to those who genuinely need a little extra help putting food on the table.

Types of Income Counted for FAP Eligibility

When Iowa determines your Food Assistance eligibility, they’re looking at almost all the money flowing into your household. This includes the obvious stuff, but also some things you might not immediately think of. Basically, if it’s coming in regularly, it’s likely counted.

- Wages and Salaries: This is your bread and butter, the money you earn from your job before taxes and other deductions.

- Self-Employment Income: We’ll get into the nitty-gritty of this one in a bit, but it’s basically the profit you make from your own business.

- Unemployment Benefits: If you’re between jobs and collecting unemployment, that income is considered.

- Social Security Benefits: This includes retirement, disability, and survivor benefits.

- Supplemental Security Income (SSI): SSI is a federal program that provides financial assistance to people with limited income and resources who are disabled, blind, or age 65 or older.

- Alimony and Child Support Payments: Money you receive from a former spouse or for your children is counted.

- Pensions and Retirement Income: Regular payments from retirement accounts are also factored in.

- Interest and Dividends: Any money earned from investments.

- Rental Income: If you own property and rent it out, that income is considered.

- Cash Assistance: Any other cash assistance you receive from the state.

- Lump-Sum Payments: This includes one-time payments like settlements, inheritances, or back payments of benefits, although these may be treated differently depending on the specific situation and regulations.

Calculating Self-Employment Income for FAP

Being your own boss is awesome, but it can complicate things when it comes to calculating your income for Food Assistance. Iowa doesn’t just look at your gross receipts; they consider your business expenses too.

Here’s the basic idea:

Gross Receipts – Business Expenses = Self-Employment Income

So, if you run a dog-walking business and earn $2,000 in a month, but spend $500 on gas, treats, and advertising, your self-employment income is $1,500.

It’s important to keep good records of all your business expenses, because these deductions can significantly impact your eligibility.

Handling Fluctuating Income with the Calculator

Life isn’t always a steady paycheck, and income can fluctuate. The Iowa Food Assistance calculator helps with this by asking for your income over a period of time, usually a month or two. This gives a more realistic picture than just looking at a single paycheck.

Here’s how it typically works:

- Provide Income History: You’ll need to provide information about your income for the past month or two, including the amount and source of the income.

- Calculate Average Income: The calculator will then average your income over that period to estimate your monthly income.

- Report Changes: If your income changes significantly (e.g., you get a new job or lose a source of income), you’ll need to report these changes to the Department of Health and Human Services (HHS) so they can update your eligibility.

Let’s say you work in a seasonal industry and your income varies a lot. In January, you might earn $1,000, but in February, you earn $3,000. The calculator would take that into account, giving a more accurate view than if it just looked at your income in January.

Allowable Deductions from Income

The good news is that not all of your income is counted. Iowa allows for certain deductions to help determine your net income, which is what they actually use to figure out your eligibility. These deductions can make a big difference in whether or not you qualify.

Here’s a rundown of the most common deductions:

- Earned Income Deduction: A portion of your earned income (wages, salaries, etc.) is deducted to encourage work.

- Child Care Costs: Expenses you pay for childcare so you can work, look for work, or attend school or training.

- Medical Expenses: For elderly or disabled individuals, out-of-pocket medical expenses (including health insurance premiums) exceeding $35 per month can be deducted.

- Shelter Costs: This includes rent or mortgage payments, property taxes, and homeowner’s insurance.

- Utility Costs: Expenses for heating, cooling, electricity, and water.

- Legally Obligated Child Support Payments: Money you pay for child support.

Comparing Treatment of Different Income Types

Not all income is treated the same way. Some types of income might be exempt or treated differently than others. For example, while wages are counted as earned income, and Social Security benefits are counted as unearned income, there may be specific rules or deductions that apply to each.

Here’s a simplified comparison:

| Income Type | Treatment |

|---|---|

| Wages | Generally counted as earned income; subject to the earned income deduction. |

| Social Security | Counted as unearned income. |

| Disability Payments | Typically treated the same as other unearned income. |

| Self-Employment | Gross receipts minus business expenses; subject to deductions for business-related costs. |

The calculator takes these differences into account, ensuring a fair assessment of your eligibility based on your specific financial situation.

Asset and Resource Considerations for FAP in Iowa: Iowa Food Stamps Eligibility Calculator

Alright, let’s talk about your stuff! When it comes to Iowa Food Assistance (FAP), also known as Food Stamps, the Iowa Department of Health and Human Services (HHS) isn’t just looking at your paycheck. They also need to know about your assets – the things you own that could potentially be converted into cash. Think of it like this: they want to make sure you truly need the help and aren’t sitting on a pile of gold bars.

We’re going to break down what counts, what doesn’t, and how it all affects your eligibility.

Assets Considered for FAP Eligibility in Iowa

Iowa HHS considers a variety of assets when determining your eligibility for FAP. These assets represent resources that could be used to cover your food expenses.

- Cash: This includes actual cash on hand, money in checking and savings accounts, and any other readily available funds.

- Stocks, Bonds, and Investments: The value of any stocks, bonds, mutual funds, or other investment accounts is considered.

- Real Estate (Other Than Your Home): If you own land, rental properties, or other real estate besides the home you live in, its value is taken into account.

- Vehicles: The value of vehicles you own is assessed.

- Personal Property: This can include items like jewelry, valuable collections, or other assets that could be sold for cash. However, this is usually less of a focus than liquid assets.

Assets Exempt from Being Counted Towards Eligibility

Not everything you own is going to count against you. There are some important exemptions that the Iowa HHS considers.

- Your Home: The home you live in is generally exempt from being counted as an asset.

- One Vehicle: Typically, one vehicle is exempt, regardless of its value.

- Certain Retirement Accounts: Funds in certain retirement accounts, like IRAs and 401(k)s, may be exempt, although the specific rules can be complex.

- Resources Specifically Excluded by Federal Law: Certain resources are excluded by federal law, such as funds from the Earned Income Tax Credit (EITC) for a limited time.

- Burial Plots and Funds: Funds set aside for burial expenses may be exempt.

Impact of Owning a Home or Other Property on FAP Eligibility

Owning a home has a specific impact on your eligibility.

- Your Primary Residence: As mentioned, your primary residence is generally exempt from being counted as an asset. This means the value of your house doesn’t affect your eligibility.

- Rental Properties or Second Homes: If you own a rental property or a second home, its value

-is* considered. The equity you have in these properties could potentially impact your eligibility. The income generated from rental properties is also considered. - Property Taxes and Home Maintenance: While the home itself is exempt, property taxes and home maintenance costs can sometimes be considered when calculating your overall expenses, which can influence your benefits.

Handling Resources Like Savings Accounts and Investments

Savings accounts and investments need careful consideration.

- Reporting Requirements: You are required to report the balances of your savings accounts, checking accounts, and the value of your investments to the Iowa HHS.

- Asset Limits: Iowa, like many states, has asset limits for FAP eligibility. If your combined assets exceed the limit, you may be ineligible, or your benefits may be affected. The exact limit changes, so always check with Iowa HHS.

- Withdrawals and Transfers: Any withdrawals or transfers from these accounts should be documented and reported. These transactions could affect your eligibility.

- Investment Income: Income generated from investments, such as dividends or interest, is considered as income, which impacts your FAP eligibility.

Reporting Changes in Assets to the Iowa Department of Health and Human Services

It’s crucial to keep the Iowa HHS informed about any changes in your assets.

- When to Report: You need to report any changes in your assets, such as a new savings account, a change in the value of your investments, or the sale or purchase of property, within a specific timeframe, usually 10 days.

- How to Report: Changes can typically be reported by phone, in writing, or online through the Iowa HHS portal.

- Documentation: Be prepared to provide documentation, such as bank statements, investment statements, or proof of sale or purchase.

- Consequences of Non-Reporting: Failing to report changes in your assets can lead to penalties, including the loss of benefits, or even legal action in severe cases.

Household Composition and Eligibility

Alright, food stamp fans, let’s talk about who’s in and who’s out when it comes to your Iowa Food Assistance (FAP) benefits. Think of it like a reality TV show – who’s living under the same roof, sharing the same pot of ramen (or gourmet meals, no judgment!), and contributing to the household budget? The FAP program has its own rules for determining who counts as a member of the “household,” and these rules can make or break your eligibility.

Get ready for the lowdown!

Determining Household Size for FAP Eligibility

The size of your household is a critical factor in calculating your FAP benefits. The more people you have, the more assistance you might be eligible for. The Iowa Department of Health and Human Services (HHS) uses a specific definition of “household” for FAP purposes, which might be different from how you define your family.To calculate the household size, the Iowa HHS considers the following:

- Living and Sharing: Individuals who live together and purchase and prepare meals together are generally considered members of the same household. This means you share a common kitchen and often eat together.

- Spouses: Married couples are always considered members of the same household, regardless of whether they share all expenses or not. Think of it as a package deal!

- Children Under 22: Children under the age of 22 who live with their parents or guardians are generally considered part of the household, even if they have their own income.

- Other Relatives: Other relatives, such as siblings, grandparents, or cousins, can be included if they meet the living and sharing criteria and are dependent on the primary household members.

- Roommates and Boarders: Roommates and boarders can be considered part of the household if they meet the living and sharing criteria. However, if they pay a fair market rent and purchase and prepare their own meals separately, they might be considered a separate household.

Household Member Inclusion Rules for FAP

Who’s in the inner circle? The rules are pretty straightforward, but let’s break them down:

- Required Inclusion: Spouses and dependent children under 22 are almost always included.

- Optional Inclusion (Dependent on Circumstances): Other relatives who live with you, purchase and prepare meals together, and are financially dependent on you can be included.

- Exclusion Criteria: Individuals who pay fair market rent, purchase and prepare their own meals separately, and are not financially dependent on the primary household members are typically excluded.

- Students: Full-time students aged 18-49 can be included in the household if they meet other eligibility criteria.

- Disabled Individuals: Disabled individuals are generally included if they meet the other criteria.

Impact of Children and Dependents on Eligibility

Having children or other dependents significantly impacts your FAP eligibility in Iowa. The number of dependents directly influences the income limits and the amount of benefits you can receive.

- Increased Benefit Amounts: The more dependents you have, the higher your potential benefit amount will be.

- Higher Income Limits: The income limits for eligibility increase as the household size grows. This means you can earn more money and still qualify for FAP if you have more dependents.

- Consideration of Childcare Costs: Childcare expenses can be deducted from your gross income, further increasing your eligibility.

- Example: Imagine two scenarios. First, a single parent with one child. The household income limits are set higher than a single individual without dependents. Second, a married couple with three children would have an even higher income limit and, likely, a greater benefit amount than the single-parent family.

Handling Multiple Families in the Same Residence

This is where things can get a little tricky, like a sitcom plot twist. What happens when multiple families live under one roof? The Iowa HHS has specific rules to determine whether they are considered separate households or one large, combined household.

- Separate Living Arrangements: If each family has its own separate living quarters, including separate cooking facilities, and purchases and prepares their meals separately, they are generally considered separate households.

- Shared Living Arrangements: If families share common living areas and purchase and prepare meals together, they are usually considered a single household.

- Financial Independence: Even if families share a residence, they may be considered separate if they are financially independent of each other and pay fair market rent.

- Example: Consider two families sharing a large house. Family A has a complete apartment with its own kitchen and separate entrance, while Family B shares the main kitchen. Family A would likely be considered a separate household.

- Example: Now consider the same situation, but Family A shares the kitchen with Family B. In this case, they’d likely be considered a single household.

Scenarios Affecting Household Composition and Eligibility, Iowa food stamps eligibility calculator

Changes in your household composition can have a significant impact on your FAP eligibility. Think of it as a plot twist in a movie – it changes everything!

- Birth of a Child: The birth of a child increases your household size, potentially increasing your benefit amount and income limits. You’ll need to report the birth to the Iowa HHS.

- Marriage: If you get married, your spouse becomes a member of your household, and their income and assets will be considered.

- Divorce: If you get divorced, your household size decreases, which could impact your eligibility.

- Moving Out: If a household member moves out, your household size decreases, and the income and assets of the person moving out will no longer be considered.

- Adding a Dependent: If you take in a dependent, like a grandchild or a disabled relative, your household size increases, potentially impacting your eligibility.

- Example: A single mother starts receiving FAP benefits. She later gets married. The new spouse’s income is considered, and the household’s eligibility may change based on the combined income.

- Example: A family of four is receiving FAP benefits. One of the children turns 18 and moves out to attend college. The household size decreases to three, potentially impacting their benefits.

Application Process for Iowa Food Assistance

Alright, so you’ve done your homework, figured out youmight* be eligible for Iowa Food Assistance (FAP), formerly known as food stamps, and now it’s time to take the plunge and apply. Think of it like applying for that coveted concert ticket – except instead of a band, you’re scoring help with groceries! The process might seem a little daunting at first, but we’ll break it down step-by-step, making it easier than ordering pizza online.

Summary of the Iowa FAP Application Process

The application process for Iowa FAP is designed to determine if you meet the eligibility requirements. It involves submitting an application, providing necessary documentation, and potentially participating in an interview. The Iowa Department of Health and Human Services (HHS) reviews your application and supporting documents, and then makes a determination. If approved, you’ll receive an EBT card loaded with benefits.

If denied, you have the right to appeal the decision. It’s like a mini-adventure, but with the reward of helping keep food on the table!

Methods to Apply for Iowa FAP

You have several options for applying for Iowa FAP, each catering to different preferences and circumstances. Choose the method that best suits your style.

- Online: This is the digital age, baby! You can apply online through the Iowa HHS website. It’s convenient, accessible 24/7, and lets you upload your documents directly. Think of it as the express lane for your application.

- By Mail: If you’re more of a snail-mail kinda person, you can download an application form from the Iowa HHS website, print it, fill it out, and mail it to the address provided. It’s like sending a letter to Santa, except you’re asking for groceries, not a pony.

- In Person: For a more face-to-face experience, you can visit your local Iowa HHS office. There, you can pick up an application, get assistance from a caseworker, and submit your documents in person. This option is great if you have questions or prefer a personal touch.

Required Documentation for Iowa FAP Application

Gathering the right paperwork is crucial. Think of it as assembling the ultimate food-prep kit. Having everything ready upfront will speed up the process and increase your chances of a smooth application. Here’s a checklist of documents you might need.

- Proof of Identity: This can be a driver’s license, state-issued ID, passport, or other official identification. This is like showing your ID at the grocery store – proving you are who you say you are.

- Proof of Income: This is the big one! You’ll need to provide documentation of all income sources, including pay stubs, unemployment benefits statements, Social Security or disability award letters, child support payments, and any other income you receive. This helps them understand your financial situation.

- Proof of Residence: A lease agreement, utility bill, or other document showing your current address is necessary. It’s like showing them where your kitchen is located.

- Proof of Resources: Bank statements, information about savings accounts, and any other assets you have. This gives them a clear picture of your financial resources.

- Social Security Numbers: For all household members applying for benefits. This is for identification purposes.

- Alien Registration Numbers: If you are not a U.S. citizen.

Tracking the Status of Your Iowa FAP Application

Once you’ve submitted your application, you’ll want to know what’s happening. Checking your application status is easier than ever.

- Online: If you applied online, you might be able to track your application status through the Iowa HHS website. Look for a dedicated portal or section where you can enter your application information and check for updates. It’s like checking the tracking number for your online order.

- By Phone: You can contact your local Iowa HHS office by phone and inquire about the status of your application. Have your application number or other identifying information ready.

- By Mail: You might receive updates by mail regarding the status of your application.

The Appeal Process for Denied Iowa FAP Applications

If your application is denied, don’t panic! You have the right to appeal the decision. It’s like asking for a second opinion from a trusted friend.

- Notification of Denial: You will receive a written notice explaining the reason for the denial. This is important because it will give you the details needed to build your appeal.

- Filing an Appeal: The notice will also provide instructions on how to file an appeal, including the deadline and the address where you should send your appeal. Make sure you submit your appeal within the timeframe.

- Appeal Hearing: You may have the opportunity to present your case at an appeal hearing, either in person or by phone.

- Review: The Iowa HHS will review your appeal and make a final decision. You will be notified of the outcome.

Maintaining FAP Eligibility in Iowa

Alright, so you’re on Food Assistance (FAP) in Iowa – congrats! But the journey doesn’t end there. Think of it like keeping your backstage pass to the best concert ever. You gotta stay on top of things to keep those benefits flowing. It’s all about playing by the rules and keeping the Iowa Department of Health and Human Services (Iowa HHS) in the loop.

Let’s break down how to keep that FAP eligibility rockin’.

Reporting Changes in Circumstances to Iowa HHS

Life throws curveballs, and your situation can change faster than a TikTok trend. It’s super important to tell Iowa HHS about any major shifts in your life that might affect your FAP eligibility. Ignoring this is a recipe for disaster, potentially leading to lost benefits and even penalties.Here’s what you need to report, ASAP:

- Changes in Income: This is a biggie. If your income goes up (new job, raise, side hustle) or down (job loss, reduced hours), you gotta let them know. Even small changes can matter.

- Address Changes: Moving? Don’t forget to update your address. Iowa HHS needs to know where to send important mail and how to contact you.

- Household Composition Changes: Did someone move in or out? Did a baby arrive? Any changes to who lives with you needs to be reported. This includes marriages, divorces, and even temporary guests staying for an extended period.

- Asset Changes: If you acquire significant assets, like a large sum of money or property, this could impact your eligibility.

- Employment Changes: Starting a new job, quitting a job, or changing your work hours all need to be reported.

How do you report these changes? You can usually do it in a few ways:

- Online: Iowa HHS likely has an online portal where you can update your information. This is often the fastest and easiest way.

- Phone: You can call the Iowa HHS office and speak to a caseworker. Have your case number ready.

- In Person: You can visit your local Iowa HHS office.

- Mail: You may be able to send a written notice to your local Iowa HHS office.

Remember, it’s always better to over-report than under-report. Keep copies of everything you submit!

Recertification and Its Frequency

Recertification is like your annual FAP check-up. Iowa HHS needs to make sure you’re still eligible. It’s not a one-and-done deal.You’ll typically need to recertify every 6 to 12 months. Iowa HHS will send you a notice in the mail telling you when your recertification is due. Don’t ignore this notice! It’s super important.During recertification, you’ll need to provide updated information about your income, assets, household composition, and other relevant details.

You might need to provide documentation, like pay stubs or bank statements. The process is similar to your initial application, but it’s a bit more streamlined since they already have your basic info.Missing your recertification deadline can lead to the suspension or termination of your benefits. Don’t let this happen! Set reminders, mark your calendar, and respond promptly to any requests from Iowa HHS.

Consequences of Losing Eligibility

Losing your FAP eligibility can be a major bummer, but it’s not always a permanent goodbye. Understanding why it happens and what to do about it is key.There are several reasons why you might lose your eligibility:

- Exceeding Income Limits: If your income goes above the allowable threshold, you’ll no longer qualify.

- Exceeding Asset Limits: If you have too many assets, like savings or investments, you might become ineligible.

- Failure to Recertify: As mentioned earlier, missing your recertification deadline is a surefire way to lose benefits.

- Failure to Report Changes: Not reporting changes in your circumstances can lead to eligibility issues.

- Fraud or Misrepresentation: This is a serious one (more on this below).

- Changes in Household Composition: Changes like a new person moving in can impact your eligibility.

If you lose your eligibility, Iowa HHS will send you a notice explaining why. The notice will also tell you if you can appeal the decision. You have the right to appeal, so don’t be afraid to do so if you think the decision is incorrect.Losing benefits can be stressful, but it’s not necessarily the end of the road. You might be able to reapply for FAP if your circumstances change.

For example, if your income decreases, you might become eligible again.

Consequences of Fraud or Misrepresentation

Playing games with the system is a big no-no. Fraud and misrepresentation are serious offenses with serious consequences.What constitutes fraud or misrepresentation? It’s basically lying or withholding information to get benefits you’re not entitled to. This includes:

- Falsely Reporting Income: Saying you earn less than you actually do.

- Hiding Assets: Not reporting assets you own.

- Providing False Information About Household Composition: Claiming someone lives with you when they don’t.

- Using Someone Else’s Benefits: Allowing someone else to use your EBT card.

The consequences of fraud can be severe:

- Loss of Benefits: You’ll definitely lose your FAP benefits.

- Financial Penalties: You might have to pay back the benefits you received fraudulently, plus penalties.

- Legal Action: In some cases, you could face criminal charges, fines, and even jail time.

- Disqualification: You could be disqualified from receiving FAP benefits for a period of time. This could be for several months or even years.

If you’re ever unsure about whether something is allowed, always err on the side of caution and ask Iowa HHS.

Staying Informed About FAP Rules and Regulations

FAP rules and regulations can change, and it’s your responsibility to stay informed. Think of it like following the plot of your favorite TV show – you don’t want to miss any plot twists!Here’s how to stay in the know:

- Check the Iowa HHS Website: The Iowa HHS website is the official source for information about FAP. Check it regularly for updates, news, and changes to the rules.

- Read Your Mail: Iowa HHS will send you important notices and updates by mail. Don’t toss these letters in the trash!

- Talk to Your Caseworker: Your caseworker is your go-to person for questions and concerns. Don’t hesitate to reach out to them.

- Follow Social Media: While not always the primary source, Iowa HHS may use social media platforms to share important announcements.

- Community Resources: Local food banks and community organizations often stay up-to-date on FAP rules and can provide assistance.

- Sign up for Alerts: Iowa HHS might offer email or text alerts to keep you informed of important changes.

Staying informed might seem like a chore, but it’s worth the effort. It’ll help you avoid problems, ensure you’re getting the benefits you’re entitled to, and keep you in the loop on any new developments.

Resources and Support for FAP Recipients in Iowa

Okay, so you’ve got your Iowa Food Assistance (FAP) benefits – awesome! But sometimes, life throws curveballs. Thankfully, Iowa’s got a whole network of resources to help you stretch those benefits and get the support you need. Think of it like this: you’ve got your food stamps, but there’s a whole buffet of extra help out there to make sure you and your family are thriving, not just surviving.

Let’s dive into what’s available.

Food Pantries and Community Support Programs

Iowa is home to numerous food pantries and community support programs designed to supplement FAP benefits. These resources can be lifesavers, especially during times of unexpected expenses or when your benefits need a little extra boost.

- Food Pantries: These are your go-to spots for groceries. They offer a variety of food items, from fresh produce to canned goods and sometimes even personal care items. Most food pantries operate on a need-based system, and you’ll typically need to provide some basic information to access their services. Many churches, community centers, and non-profit organizations run these pantries. Find your local food pantry by searching online using “Iowa food pantry” plus your city or county.

- Mobile Food Pantries: Think of these as food pantries on wheels! They bring food directly to communities with limited access to grocery stores or food pantries. They often have a rotating schedule, so check their website or social media for locations and times.

- Community Kitchens: These places serve hot, nutritious meals to anyone in need. They can be a great option if you’re struggling to cook at home or simply need a warm meal.

- Supplemental Nutrition Assistance Program (SNAP) Outreach: Many organizations offer assistance with the SNAP application process, helping you navigate the paperwork and understand your rights. They can also connect you with other resources, like job training programs or housing assistance.

- Community Action Agencies: These agencies offer a wide range of services, including food assistance, energy assistance, and housing support. They’re a great place to start if you’re facing multiple challenges.

Contact Information for the Iowa Department of Health and Human Services

Need to reach the big dogs? The Iowa Department of Health and Human Services (HHS) is the central hub for all things FAP. Here’s how to get in touch:

- Phone: 1-800-942-8435. This is the main number for FAP inquiries and application status updates.

- Website: You can find a wealth of information, including application forms, program details, and frequently asked questions, on the Iowa HHS website: [https://dhs.iowa.gov/](https://dhs.iowa.gov/).

- Local Offices: Iowa HHS has local offices across the state. You can find the office closest to you using the online office locator on the Iowa HHS website or by calling the 1-800 number.

Relevant Websites and Online Resources

The internet is your friend! These websites provide valuable information and tools to help you manage your FAP benefits and access additional support.

- Iowa Department of Health and Human Services (HHS): As mentioned, the official HHS website ([https://dhs.iowa.gov/](https://dhs.iowa.gov/)) is your primary source for all things FAP.

- Food Bank of Iowa: This organization supports food pantries across the state and provides resources for those in need: [https://www.foodbankiowa.org/](https://www.foodbankiowa.org/).

- Feeding America: This national organization has a network of food banks, including the Food Bank of Iowa. You can find resources and information about food assistance programs on their website: [https://www.feedingamerica.org/](https://www.feedingamerica.org/).

- 2-1-1 Iowa: This free, confidential service connects individuals with health and human service programs in their local communities. You can dial 2-1-1 or visit their website: [https://www.211iowa.org/](https://www.211iowa.org/). It’s like a super-powered phone book for social services!

Finding Local Assistance with the Application Process

Navigating the FAP application process can sometimes feel like trying to solve a Rubik’s Cube blindfolded. Luckily, you don’t have to go it alone.

- Community Action Agencies: These agencies often provide free assistance with the FAP application process. They can help you gather the necessary documentation, complete the application form, and understand the eligibility requirements.

- Local Food Pantries: Many food pantries have staff or volunteers who can help you with the application process or refer you to other resources.

- SNAP Outreach Programs: These programs specialize in assisting individuals with the SNAP application process and can provide personalized support.

- Iowa HHS Local Offices: You can visit your local Iowa HHS office for assistance with the application process. They can answer your questions and help you complete the necessary paperwork.

Using the EBT Card and Accessing Benefits

Your Electronic Benefit Transfer (EBT) card is your key to accessing your FAP benefits. It works just like a debit card, but it can only be used to purchase eligible food items.

- Activation: You’ll need to activate your EBT card before you can use it. Instructions on how to activate your card will be included when you receive it. Usually, this involves calling a toll-free number or visiting a website.

- PIN: You’ll need to create a Personal Identification Number (PIN) for your EBT card. Keep your PIN safe and don’t share it with anyone.

- Purchasing Food: You can use your EBT card at most grocery stores, supermarkets, and participating farmers’ markets. Look for the EBT logo at the checkout. You can purchase most food items, including fruits, vegetables, meat, poultry, fish, dairy products, and cereals.

- Checking Your Balance: You can check your EBT card balance in several ways:

- Online: Visit the Iowa HHS website or the website of your EBT card provider.

- By Phone: Call the customer service number on the back of your EBT card.

- At the Store: Ask the cashier to check your balance.

- Restricted Items: Your EBT card cannot be used to purchase non-food items, such as alcohol, tobacco, pet food, or household supplies.

- Lost or Stolen Card: If your EBT card is lost or stolen, report it immediately to the customer service number on the back of your card. Your benefits can be protected, and a replacement card can be issued.

Special Considerations and Scenarios

Alright, food stamp fam! Life throws curveballs, and sometimes those curveballs affect your ability to put food on the table. This section is all about those special situations – the stuff that doesn’t always fit neatly into the standard eligibility box. We’re talking college students, immigrants, overpayments, emergencies, and how major events can shake things up. Buckle up, buttercups!

Eligibility for College Students in Iowa

College life is a rollercoaster, and affording food shouldn’t be another drop. The rules for Iowa college students and Food Assistance Program (FAP) eligibility are pretty specific, and it’s not always a slam dunk. Generally, if you’re enrolled at least half-time in an institution of higher education, you’re

-not* automatically eligible. But, like any good drama, there are plot twists.

- Work Requirement: The biggie. To be eligible, you usually need to meet a work requirement. This means working at least 20 hours a week, or participating in a federal or state work study program.

- Exemptions: There are exceptions to the rule. You might be exempt if you are:

- Eligible to participate in a work study program, even if you aren’t currently participating.

- A single parent with a child under 6 years old.

- Receiving Temporary Assistance for Needy Families (TANF) benefits.

- Physically or mentally unfit for work.

- Other Considerations: Even if you meet the requirements, your income and resources still need to fall within the FAP guidelines. This includes student loans, grants, and any other financial aid. Make sure to declare these as income.

Real-Life Example: Imagine Sarah, a full-time student at the University of Iowa. She works 25 hours a week at the campus library. Because she meets the work requirement, and her income and resources are within the limits, she’s eligible for FAP. Meanwhile, her friend, Mark, also a full-time student, doesn’t work and isn’t exempt. He’s likely ineligible, unless he finds a work-study program.

It’s a tale of two Hawkeyes!

Treatment of Immigrants and Non-Citizens Regarding FAP Eligibility

Navigating the immigration system is complicated, and FAP eligibility for immigrants and non-citizens adds another layer of complexity. The rules are designed to ensure that only eligible individuals receive benefits, and these rules can vary depending on immigration status.

- Qualified Aliens: Certain non-citizens, considered “qualified aliens,” may be eligible. This includes lawful permanent residents (green card holders), refugees, asylees, and individuals granted withholding of deportation.

- Five-Year Bar: Many qualified aliens are subject to a five-year waiting period, starting from the date they obtain qualified alien status, before they can receive FAP benefits.

- Exceptions to the Five-Year Bar: There are exceptions. Some qualified aliens are exempt from the five-year bar, including:

- Refugees, asylees, and individuals granted withholding of deportation.

- Those who have been victims of domestic violence or human trafficking.

- Other Non-Citizens: Other non-citizens, such as those with temporary visas, are generally not eligible for FAP.

- Sponsor’s Income: When determining eligibility, the income and resources of a sponsor (someone who has signed an affidavit of support) may be considered for a certain period.

Real-Life Example: Maria, a refugee from Syria, is granted asylum in the US. She is immediately eligible for FAP, as refugees are exempt from the five-year bar. Conversely, Carlos, a student from Brazil on a student visa, is not eligible for FAP because he is not a qualified alien.

Rules Regarding Overpayments and How to Resolve Them

Oops! Sometimes, mistakes happen, and the FAP program may inadvertently pay you more than you’re entitled to. It’s not the end of the world, but it needs to be addressed. Overpayments can occur for various reasons, from unreported income changes to errors made by the Department of Health and Human Services (HHS).

- What is an Overpayment?: An overpayment is when you receive more FAP benefits than you should have, based on your actual income, resources, and household circumstances.

- Reporting Requirements: You have a responsibility to report any changes in your circumstances that could affect your eligibility, such as changes in income, employment, or household composition.

- Notification of Overpayment: If an overpayment is identified, the Iowa Department of Health and Human Services (HHS) will notify you in writing. The notice will explain the reason for the overpayment, the amount owed, and your repayment options.

- Repayment Options: You’ll typically have several options for repaying the overpayment:

- Payment in full: Paying the entire amount at once.

- Installment plan: Agreeing to a monthly payment plan.

- Offsetting future benefits: Having a portion of your future FAP benefits withheld each month until the overpayment is repaid.

- Appealing an Overpayment: If you disagree with the overpayment determination, you have the right to appeal. The appeal process involves submitting a written request for a hearing and presenting your case to an administrative law judge.

Real-Life Example: Let’s say David starts a part-time job but forgets to report the income to the Iowa HHS. As a result, he receives an overpayment of $500. The HHS notifies him and offers him a choice of paying it back in full, setting up an installment plan, or having $50 deducted from his monthly benefits until the $500 is repaid.

David chooses the installment plan.

Information on Emergency Food Assistance Programs in Iowa

Sometimes, life throws you a curveball, and you need help

-now*. Emergency food assistance programs are designed to provide short-term help when you’re facing a crisis. These programs can be a lifeline during a sudden job loss, unexpected medical bills, or other emergencies.

- Food Pantries: These are the workhorses of emergency food assistance. Food pantries distribute groceries and other food items to individuals and families in need. You can usually find food pantries through local charities, churches, and community organizations.

- Food Banks: Food banks are larger organizations that collect and distribute food to food pantries and other agencies. They often have relationships with grocery stores and food manufacturers to secure donations.

- Soup Kitchens: Soup kitchens provide hot meals to people who are hungry. They’re often open on a regular schedule and serve meals to anyone who needs them.

- Emergency Food Assistance Program (EFAP): This federal program provides food to states, which then distribute it to local agencies, including food banks and food pantries.

- TEFAP (The Emergency Food Assistance Program): A federal program providing food assistance to low-income individuals and families.

Real-Life Example: Maria, who just moved to Iowa, suddenly loses her job. She needs immediate help to feed her family. She searches online for “food pantries near me” and finds a local food pantry that provides her with a box of groceries to tide her over until she can get back on her feet. She also finds out about the local soup kitchen where she can get a hot meal daily.

Impact of COVID-19 and Other Major Events on FAP Eligibility and Benefits

The COVID-19 pandemic, and other major events, showed us how quickly things can change and how vulnerable people can be. These events can significantly impact FAP eligibility and benefits. It’s important to stay informed about any temporary changes or new policies.

- Temporary Benefit Increases: During the COVID-19 pandemic, the federal government authorized temporary increases in FAP benefits to help families cope with the economic fallout.

- Waivers of Certain Requirements: The Iowa HHS, and the federal government, may waive certain requirements during emergencies, such as work requirements or time limits.

- Simplified Application Processes: To make it easier for people to apply for FAP during the pandemic, application processes may be simplified, and documentation requirements may be relaxed.

- Changes to Income and Resource Limits: Major events, like widespread job losses, can lead to adjustments in income and resource limits to ensure more people are eligible.

- Disaster SNAP (D-SNAP): After a natural disaster, the federal government may authorize D-SNAP, which provides temporary food assistance to individuals and families who are not normally eligible for FAP.

Real-Life Example: During the COVID-19 pandemic, many Iowans lost their jobs. The federal government authorized a temporary increase in FAP benefits, which helped families afford food while they looked for new employment. The Iowa HHS also temporarily waived the work requirements for some recipients, recognizing the challenges in finding work during the pandemic.

Closing Notes

In conclusion, grasping the nuances of the Iowa Food Assistance Program is essential for those seeking support. From the initial eligibility assessment with the iowa food stamps eligibility calculator to maintaining benefits and accessing available resources, this guide provides a roadmap. Understanding income and asset considerations, navigating household composition rules, and adhering to reporting requirements are key to ensuring access to the program.

The program is designed to serve as a vital lifeline, and the knowledge of how to use the resources available ensures its effectiveness.