Alright, let’s talk about food stamp eligibility calculator CT, yeah? Think of it like this: you’re chilling in Bali, but instead of surfing, you’re figuring out how to score some SNAP benefits in Connecticut. This guide is your chill companion, breaking down everything from income limits to the nitty-gritty of the application process. We’re keeping it real, no confusing jargon, just the deets on how to get the help you need, so you can focus on, well, living your best life.

We’ll dive into the Supplemental Nutrition Assistance Program (SNAP) in CT, explaining who it’s for and what you need to qualify. We’ll also cover income and asset limits, the application process, and how to use a handy-dandy food stamp eligibility calculator. Plus, we’ll give you the lowdown on what you can buy with those benefits and how to keep them flowing smoothly.

Consider this your go-to resource for navigating the system without the stress, yeah?

Overview of Food Stamp Program in Connecticut

The Supplemental Nutrition Assistance Program (SNAP) in Connecticut, formerly known as the Food Stamp Program, provides vital nutritional assistance to eligible low-income individuals and families. It aims to alleviate hunger and improve the health and well-being of those most vulnerable in the state. SNAP benefits are used to purchase food items at authorized retail food stores.

Purpose and Beneficiaries of SNAP

SNAP’s primary purpose is to combat food insecurity by supplementing the food budgets of eligible households. This allows individuals and families to afford nutritious meals, improving their overall health and well-being. The program benefits a wide range of individuals, including children, seniors, people with disabilities, and working families with low incomes. The program is designed to support those who may struggle to afford adequate food due to factors like unemployment, low wages, or unexpected expenses.

Basic Requirements for Connecticut SNAP Participation

To participate in the Connecticut SNAP program, applicants must meet specific eligibility requirements. These requirements are designed to ensure that benefits are directed to those most in need.

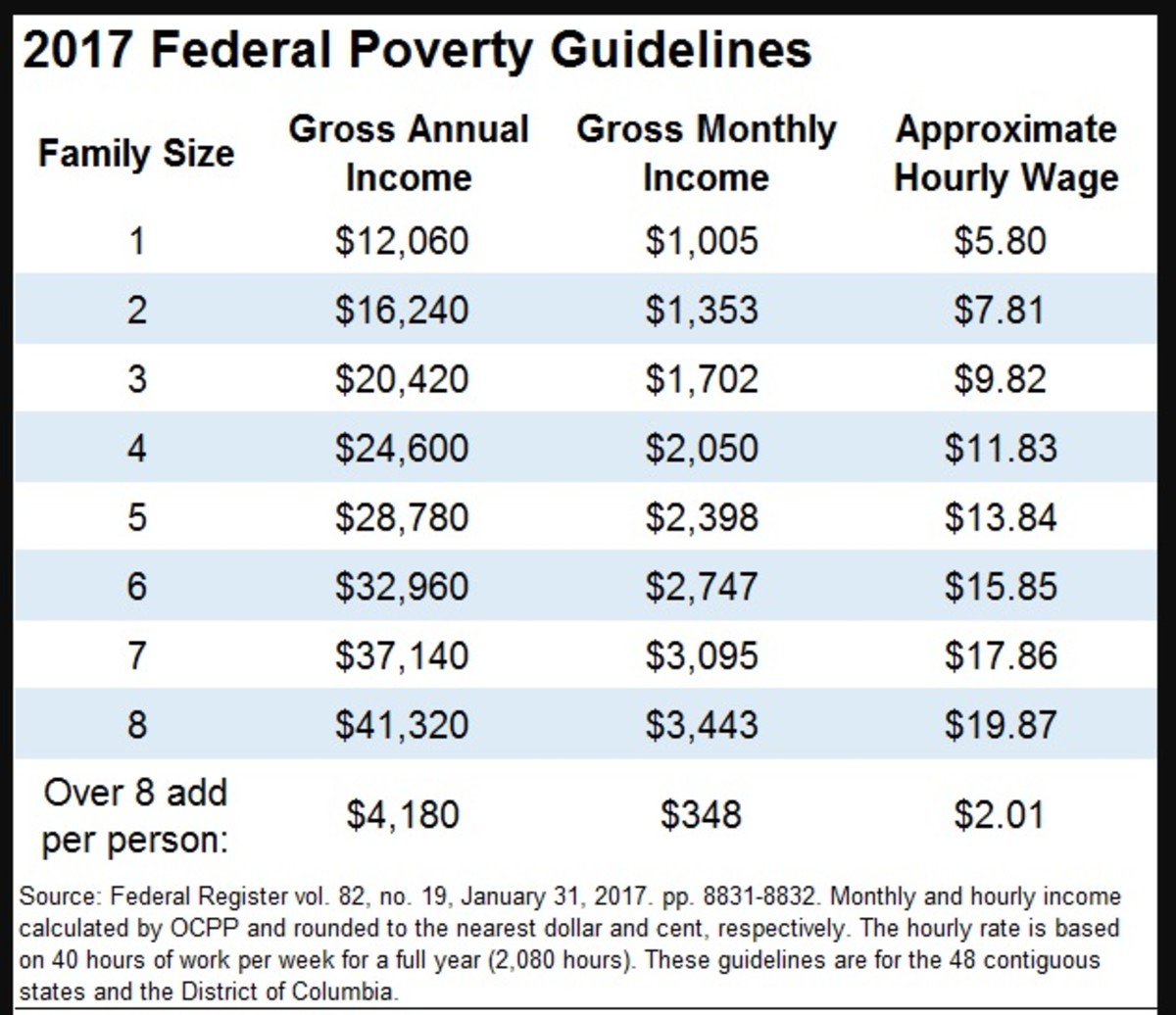

- Income Limits: Household gross monthly income must generally be at or below 200% of the federal poverty level. These limits are adjusted annually and vary depending on household size. For example, as of October 2024, a household of three may have a gross monthly income of up to approximately $4,680 to be eligible.

- Resource Limits: Households must also meet resource limits, which refer to the value of countable assets such as bank accounts, stocks, and bonds. The resource limit is generally $4,250 for households with a member age 60 or older or disabled, and $2,750 for all other households.

- Work Requirements: Able-bodied adults without dependents (ABAWDs) may be subject to work requirements to maintain eligibility. These requirements may involve working a certain number of hours per week or participating in a work training program.

- Residency: Applicants must be residents of Connecticut.

- Citizenship/Immigration Status: While U.S. citizens are generally eligible, certain non-citizens who meet specific immigration requirements may also qualify.

Meeting these requirements doesn’t guarantee eligibility, as other factors, such as certain deductions, can impact the final determination. The Connecticut Department of Social Services (DSS) determines eligibility based on the information provided by the applicant and verification of the applicant’s circumstances. For instance, a household of two with a monthly gross income of $3,000, combined with countable resources under $2,750, would likely be eligible, assuming other requirements are met.

However, the actual benefit amount is calculated based on household size and income.

Examine how daytona beach food trucks can boost performance in your area.

Eligibility Criteria

Understanding the income guidelines is crucial for determining your eligibility for the Supplemental Nutrition Assistance Program (SNAP) in Connecticut. These guidelines are designed to ensure that SNAP benefits reach those households most in need of food assistance. This section provides a clear overview of the income limits, calculations, and considerations used in determining SNAP eligibility.

Income Limits for SNAP Eligibility in Connecticut

SNAP eligibility in Connecticut hinges on meeting specific income thresholds. These thresholds are adjusted annually based on the federal poverty guidelines and are designed to reflect the cost of living in the state. Both gross and net income are considered when evaluating a household’s eligibility.The Connecticut Department of Social Services (DSS) uses both gross and net income to assess eligibility.* Gross Income: This is the total amount of money a household receives before any deductions.

It includes earnings from employment, self-employment, Social Security benefits, unemployment compensation, and other sources of income.

Net Income

This is the gross income minus certain deductions, such as standard deductions, earned income deductions, childcare expenses, medical expenses for elderly or disabled members, and legally obligated child support payments.The specific income limits vary depending on the size of the household. It is essential to accurately calculate both your gross and net income to determine if you meet the eligibility criteria.Here’s a table illustrating the approximate monthly gross income limits for SNAP eligibility in Connecticut as of 2024.

These figures are subject to change, so always refer to the most current guidelines from the Connecticut DSS. This table provides a clear visual representation of how income limits change based on household size.

| Household Size | Monthly Gross Income Limit | Monthly Net Income Limit | Example |

|---|---|---|---|

| 1 | $2,740 | $2,108 | An individual earning $2,600 per month, with minimal deductions, might be eligible. |

| 2 | $3,701 | $2,846 | A couple earning a combined $3,500 per month, after deductions, could qualify. |

| 3 | $4,662 | $3,585 | A family of three earning $4,400 monthly, after deductions, might be eligible. |

| 4 | $5,623 | $4,323 | A family of four with a monthly income of $5,400, after deductions, could potentially qualify. |

Calculating Income for SNAP

Accurately calculating income is a crucial step in determining SNAP eligibility. The calculation process involves identifying all sources of income and then applying allowable deductions to arrive at the net income.The following are some key points to remember when calculating income for SNAP:* Income Sources: Income includes, but is not limited to, wages, salaries, self-employment earnings, Social Security benefits, unemployment compensation, pensions, and alimony.

It is essential to provide documentation for all sources of income.

What is Considered Income

Wages and salaries from employment.

Self-employment earnings (after deducting business expenses).

Social Security benefits (retirement, disability, survivor).

Unemployment compensation.

Child support payments received.

Alimony received.

Rental income (after deducting expenses).

Interest and dividends from investments.

What is NOT Considered Income

SNAP benefits themselves.

Student financial aid that is used for tuition, fees, and other educational expenses.

Loans (including student loans).

Gifts of cash or other items that are not intended for ongoing support.

Income tax refunds. –

Deductions

Standard deductions.

Earned income deduction (for those with earned income).

Childcare expenses (necessary for work, training, or education).

Medical expenses (for elderly or disabled members, exceeding a certain threshold).

Legally obligated child support payments.

Accurate income reporting is essential for SNAP eligibility. Failure to report all income or to accurately calculate deductions can lead to denial of benefits or penalties.

Application Process

Navigating the application process for SNAP benefits in Connecticut can seem daunting, but understanding the steps involved can simplify the process. This section provides a clear roadmap, guiding you through each stage and ensuring you have the necessary information to successfully apply for food assistance.

Steps to Apply for SNAP Benefits

The application process for SNAP in Connecticut involves several key steps, each designed to assess eligibility and ensure fair distribution of benefits.

- Gather Required Information: Before starting the application, gather all necessary documentation. This will streamline the process and prevent delays.

- Obtain the Application Form: The application form can be obtained through several channels. You can download it online, request it by mail, or pick it up in person at a local Department of Social Services (DSS) office.

- Complete the Application: Fill out the application form accurately and completely. Provide all requested information, including household details, income, and expenses. Be sure to sign and date the application.

- Submit the Application: Submit the completed application form and supporting documentation to the DSS. Applications can be submitted online, by mail, or in person at a DSS office.

- Attend an Interview (If Required): The DSS may contact you for an interview to verify the information provided in your application. Be prepared to answer questions about your household and financial situation.

- Await a Decision: The DSS will review your application and supporting documentation. You will receive a written notice informing you of their decision regarding your eligibility for SNAP benefits.

- Receive Benefits (If Approved): If approved, you will receive a SNAP Electronic Benefit Transfer (EBT) card, which can be used to purchase eligible food items at authorized retailers.

Locating Application Forms and Submission Methods

Finding the application form and knowing where to submit it are crucial first steps. Connecticut provides several accessible options.

Application Form Availability:

- Online: The application form is available for download on the Connecticut Department of Social Services (DSS) website.

- By Mail: You can request an application form by calling the DSS or by writing a letter to their office.

- In Person: Application forms are available at local DSS offices throughout the state.

Submission Methods:

- Online: Completed applications can be submitted online through the DSS website.

- By Mail: Mail the completed application and supporting documentation to the address provided on the application form.

- In Person: Submit your application and documentation in person at your local DSS office.

Documentation Required for SNAP Application

Providing accurate and complete documentation is essential for a smooth application process. The DSS requires specific documentation to verify eligibility.

Required Documentation:

- Proof of Identity: Examples include a driver’s license, state-issued ID card, or passport.

- Proof of Address: Examples include a utility bill, lease agreement, or a piece of mail addressed to you at your current residence.

- Proof of Income: This can include pay stubs, unemployment benefits statements, or self-employment records.

- Proof of Resources: This includes documentation of any bank accounts, savings accounts, or other assets.

- Verification of Expenses: Examples include rent or mortgage statements, utility bills, and medical expenses.

- Social Security Numbers: For all household members applying for benefits.

Using a Food Stamp Eligibility Calculator

Navigating the path to food assistance can feel overwhelming. Fortunately, technology provides a valuable tool: the food stamp eligibility calculator. This resource helps potential applicants quickly assess their likelihood of qualifying for the Supplemental Nutrition Assistance Program (SNAP), making the application process less daunting.

Purpose of a Food Stamp Eligibility Calculator, Food stamp eligibility calculator ct

The primary function of a food stamp eligibility calculator is to provide an initial estimate of a household’s SNAP eligibility. This estimate is based on the information entered by the user and compares it against the current income and resource limits established by the Connecticut Department of Social Services (DSS). The calculator helps individuals and families understand if they meet the basic financial requirements for SNAP benefits.

It’s important to remember that the calculator provides an estimate and does not guarantee eligibility. The final determination is made by the DSS after a formal application is submitted and reviewed.

Information Needed to Use a Connecticut Food Stamp Eligibility Calculator

To effectively use a Connecticut food stamp eligibility calculator, you’ll need to gather specific information about your household. This information is crucial for the calculator to provide an accurate estimate. Be prepared to provide details on:

- Household Size: The number of individuals living in your home who share meals and expenses. This includes children, adults, and any other dependents.

- Gross Monthly Income: This is the total amount of money earned before taxes and deductions, including wages, salaries, self-employment income, unemployment benefits, Social Security benefits, and any other sources of income.

- Allowable Deductions: Information regarding specific deductions is necessary. These deductions reduce the amount of income considered when determining eligibility. Common deductions include:

- Dependent Care Expenses: Costs associated with childcare or elder care that are necessary for a household member to work, look for work, or attend school.

- Medical Expenses: Out-of-pocket medical expenses exceeding $35 per month for elderly or disabled household members.

- Shelter Costs: Rent or mortgage payments, property taxes, and insurance.

- Child Support Payments: Court-ordered child support payments made by a household member.

- Resources: The value of any countable assets, such as cash, bank accounts, stocks, and bonds. Certain assets, like a primary home and one vehicle, are typically excluded.

Mock-up of a Calculator’s Input Fields

Here’s a simplified example of the input fields you might find in a Connecticut food stamp eligibility calculator:

| Field | Description | Example |

|---|---|---|

| Household Size | Number of people living in your household | 4 |

| Gross Monthly Income (Wages/Salary) | Total income before taxes from employment | $3,000 |

| Gross Monthly Income (Other) | Income from other sources (e.g., Social Security, Unemployment) | $500 |

| Dependent Care Expenses (Monthly) | Monthly cost of childcare or elder care | $400 |

| Medical Expenses (Monthly – for elderly/disabled) | Out-of-pocket medical costs over $35 | $100 |

| Rent/Mortgage Payment (Monthly) | Your housing costs | $1,200 |

| Child Support Payments (Monthly) | Court-ordered child support paid | $200 |

| Cash Assets (Savings, Checking) | Total cash in bank accounts | $500 |

| Vehicle Value | The value of the primary vehicle | (This field is often informational, as the primary vehicle is usually exempt.) |

| Click here to calculate eligibility | Button to process the entered information | Calculate |

Disclaimer: The above table represents a simplified example. Actual calculators may include additional fields and options. The accuracy of the calculation depends on the accuracy of the information entered.

Factors Affecting Eligibility

Understanding how life changes can impact your SNAP (Supplemental Nutrition Assistance Program) benefits is crucial for maintaining access to food assistance. Changes in your financial situation, the people you live with, or your employment status can all affect your eligibility. Being proactive in reporting these changes is essential to avoid potential benefit disruptions or, conversely, to ensure you receive the correct level of assistance.

Changes in Income

Your income is a primary factor in determining your SNAP eligibility. Both increases and decreases in income must be reported to the Department of Social Services (DSS).

- Increased Income: An increase in your earned income (wages from a job) or unearned income (such as Social Security benefits, unemployment compensation, or child support) can potentially decrease your SNAP benefits or make you ineligible. For example, if a SNAP recipient gets a raise at their job that pushes their monthly income above the income limit for their household size, their benefits may be reduced or terminated.

- Decreased Income: Conversely, a decrease in income, such as a reduction in work hours or the loss of a job, may increase your SNAP benefits. It’s important to report such changes promptly. This ensures you receive the appropriate level of assistance based on your current financial circumstances.

Changes in Employment

Changes in your employment status directly impact your income, and therefore, your SNAP eligibility.

- Starting a New Job: Beginning a new job typically means an increase in income, which, as discussed above, needs to be reported.

- Losing a Job: Losing your job usually results in a decrease in income, and potentially qualifies you for increased SNAP benefits. Additionally, you may qualify for temporary unemployment benefits.

- Changes in Work Hours: Changes in the number of hours you work can also affect your income. A reduction in hours could decrease your income and potentially increase your SNAP benefits. An increase in hours could have the opposite effect.

Changes in Household Composition

Changes in the size of your household directly impact your SNAP benefits. The number of people in your household determines the maximum amount of SNAP benefits you are eligible to receive.

- Adding a Household Member: If someone moves into your home and becomes part of your SNAP household (for example, a new baby, a spouse, or a relative), you must report this change. This might increase your benefit amount, as the additional person increases your household size.

- Removing a Household Member: If someone moves out of your home, or is no longer considered part of your SNAP household, you must also report this change. This might decrease your benefit amount, as the household size has decreased.

- Marital Status Changes: Marriage or divorce affects household composition and income, and should be reported to the DSS.

Reporting Changes to the Department of Social Services (DSS)

Prompt and accurate reporting of changes is crucial to avoid benefit disruptions and potential overpayments or underpayments.

- Methods of Reporting: You can report changes to the DSS in several ways, including online through the myDSS portal, by phone, by mail, or in person at your local DSS office.

- Required Information: When reporting changes, you’ll need to provide details about the specific change (e.g., new employer, new income amount, new household member), along with supporting documentation (e.g., pay stubs, proof of address, birth certificate).

- Timeliness of Reporting: You are generally required to report changes within 10 days of the change occurring. Failing to do so could result in a penalty, such as a reduction in benefits or, in cases of intentional misreporting, a period of ineligibility.

- Example of a Benefit Change: Imagine a single-parent household currently receives $300 per month in SNAP benefits. The parent gets a part-time job, increasing their monthly income by $500. Based on the SNAP guidelines, the benefits might be reduced by approximately $150, resulting in new monthly benefits of $150. This adjustment ensures the assistance aligns with the household’s current financial situation.

Verification and Documentation

Providing accurate documentation is a critical step in the food stamp application process in Connecticut. The Department of Social Services (DSS) requires specific documents to verify your eligibility, ensuring that benefits are provided to those who genuinely need them. This process helps maintain the integrity of the program and ensures fair distribution of resources.

Types of Documentation Required

The DSS needs various documents to confirm the information provided on your application. This verification process aims to prevent fraud and ensure that only eligible individuals and families receive food assistance. It’s essential to gather all necessary documentation before applying to streamline the process and avoid delays.

Acceptable Forms of Identification

To verify your identity, the DSS accepts several forms of identification. Presenting valid identification is a fundamental requirement for confirming your identity and ensuring you are who you claim to be on your application.

- Driver’s License or State-Issued ID: A valid driver’s license or state-issued identification card is commonly accepted. This serves as primary proof of identity and includes a photograph.

- Passport: A valid U.S. passport or passport card is also a universally accepted form of identification. It provides strong verification of identity and citizenship.

- U.S. Military ID: Active or retired U.S. military identification cards are accepted. This confirms identity and service status.

- Birth Certificate: An official birth certificate can be used, especially if other forms of photo identification are unavailable. This document verifies your date and place of birth.

- Other Government-Issued Documents: Documents such as a Social Security card or a Resident Alien Card (Green Card) are also acceptable, though they may need to be accompanied by other forms of identification.

Proof of Residency

Proof of residency is necessary to confirm that you live in Connecticut and are therefore eligible for the state’s food stamp program. This is important to ensure that the program serves its intended population.

- Utility Bills: Recent utility bills (e.g., electricity, gas, water) in your name and showing your current address are commonly accepted. These bills provide direct proof of your physical location.

- Lease Agreement or Mortgage Statement: A current lease agreement or mortgage statement demonstrates that you reside at a specific address. These documents establish your legal right to occupy the residence.

- Bank Statements: Bank statements with your current address printed on them can serve as proof of residency. These statements provide evidence of your financial activity and physical location.

- Mail from Government Agencies: Official mail from government agencies, such as the IRS or Social Security Administration, can also be used to verify your address. These documents provide reliable confirmation of your residency.

- Other Official Correspondence: Other official correspondence, such as a letter from a healthcare provider or school, may be accepted, provided it includes your name and current address.

Proof of Income

Verifying your income is a critical step in determining your eligibility for food stamps. The DSS needs to assess your financial resources to ensure that you meet the income requirements.

- Pay Stubs: Recent pay stubs from your employer are the primary form of income verification. These documents detail your gross income, deductions, and net pay.

- Tax Returns: Copies of your most recent federal and state income tax returns (Form 1040) are used to verify annual income. This provides a comprehensive overview of your earnings.

- Self-Employment Records: If you are self-employed, you must provide records of your income and expenses. This may include profit and loss statements, bank statements, and receipts.

- Social Security or Retirement Benefits Statements: Official statements from the Social Security Administration or other retirement funds verify your benefits. These documents show the amount of income you receive.

- Unemployment Compensation Documentation: Documentation from the Department of Labor verifying unemployment benefits is necessary. This confirms the amount and duration of your benefits.

- Child Support Documentation: Documentation of child support payments received, such as court orders or payment records, must be provided. This helps to accurately assess your total income.

- Other Income Sources: Any other sources of income, such as alimony, rental income, or investment income, must be documented with relevant supporting evidence.

Benefit Amounts and Usage: Food Stamp Eligibility Calculator Ct

Understanding how SNAP benefits work in Connecticut is crucial for maximizing their effectiveness. This section delves into how benefit amounts are calculated, how they can be used, and the specific items that are and are not eligible for purchase. Knowing these details ensures you can make the most of the assistance provided.

Determining SNAP Benefit Amounts in Connecticut

The amount of SNAP benefits a household receives in Connecticut is not a fixed sum but is determined based on several factors. These factors are used to calculate a household’s monthly benefit.The primary factors include:

- Household Size: The number of people living in the household and sharing food expenses is the most significant determinant. Larger households generally receive higher benefit amounts to cover the increased food needs.

- Gross Monthly Income: SNAP considers a household’s total monthly income before certain deductions are applied. This includes earned income (wages, salaries), unearned income (Social Security, unemployment benefits, pensions), and other sources of income.

- Allowable Deductions: Certain expenses are deducted from the gross monthly income to arrive at the net monthly income. These deductions can significantly impact the benefit amount.

- Asset Limits: SNAP also considers the value of certain assets, such as savings accounts and investments, though these limits are typically more lenient than income-based requirements.

The Connecticut Department of Social Services (DSS) uses a standardized formula based on these factors. The formula calculates the household’s net monthly income and then compares it to the maximum allowable income for the household size. The difference between the net income and the maximum benefit for the household size determines the monthly SNAP benefit amount.For example:

A single-person household with a net monthly income of $500 might receive a benefit amount that is calculated by subtracting their net income from the maximum benefit amount for a single-person household. This amount would vary based on the year and the specific maximum benefit levels set by the USDA.

Using SNAP Benefits

SNAP benefits are designed to help low-income individuals and families purchase food. These benefits are provided on an Electronic Benefit Transfer (EBT) card, which functions like a debit card.The EBT card can be used at authorized retailers, including:

- Grocery Stores: Supermarkets, local grocery stores, and convenience stores that accept SNAP benefits.

- Farmers Markets: Many farmers markets across Connecticut allow SNAP users to purchase fresh produce and other eligible food items directly from farmers.

- Online Retailers: SNAP benefits can be used to purchase groceries online from approved retailers like Amazon and Walmart.

When using the EBT card, the process is similar to using a debit card. The cardholder swipes the card, enters a PIN, and the purchase amount is deducted from the SNAP benefit balance.

Eligible and Ineligible Food and Items

Understanding what can and cannot be purchased with SNAP benefits is critical to proper usage. SNAP has specific guidelines about the types of food and items that are eligible.The following are examples of items that can be purchased with SNAP benefits:

- Fruits and Vegetables: Fresh, frozen, and canned fruits and vegetables.

- Meat, Poultry, and Fish: All types of meat, poultry, and fish.

- Dairy Products: Milk, cheese, yogurt, and other dairy items.

- Breads and Cereals: Breads, cereals, pasta, rice, and other grains.

- Seeds and Plants: Seeds and plants that produce food for the household to eat.

- Snack Foods: Chips, crackers, cookies, and other snack items.

- Non-Alcoholic Beverages: Sodas, juices, and other non-alcoholic drinks.

Conversely, certain items are not eligible for purchase with SNAP benefits.These ineligible items include:

- Alcoholic Beverages: Beer, wine, and liquor.

- Tobacco Products: Cigarettes, cigars, and other tobacco products.

- Non-Food Items: Soaps, paper products, pet food, and other household supplies.

- Vitamins and Medicines: Vitamins, supplements, and over-the-counter medicines.

- Prepared Foods (Hot Foods): Foods that are hot at the point of sale (with some exceptions, like those provided through the Restaurant Meals Program).

Knowing these rules helps SNAP recipients make informed purchasing decisions and ensures they are using their benefits correctly.

Recertification and Renewal

Maintaining your SNAP benefits in Connecticut requires a proactive approach. This involves understanding and successfully navigating the recertification and renewal processes. These procedures ensure that you continue to receive the food assistance you need to support yourself and your family. Timely action is crucial; failure to comply can lead to a lapse in benefits.

Recertifying for SNAP Benefits in Connecticut

Recertification is the process of verifying your continued eligibility for SNAP benefits. This is not a one-time event; it’s a recurring requirement. The Connecticut Department of Social Services (DSS) will notify you when it’s time to recertify. This notification will Artikel the required steps and provide a deadline.To recertify, you’ll typically need to:

- Complete a recertification form, provided by the DSS. This form will ask for updated information about your household income, resources, and living situation.

- Provide documentation to support the information you provide. This may include pay stubs, bank statements, proof of rent or mortgage payments, and information about any other sources of income.

- Participate in an interview with a DSS caseworker, either in person or by phone. The interview is an opportunity for the caseworker to clarify any information and to ensure that you understand your rights and responsibilities.

- Respond promptly to any requests for information from the DSS.

Timeline for Recertification and Consequences of Non-Recertification

The DSS will send you a notice about 30 days before your SNAP benefits expire, indicating the need for recertification. The recertification process must be completed by the deadline specified in the notice. Missing this deadline has significant consequences.If you fail to recertify by the deadline, your SNAP benefits will be terminated. You will no longer receive food assistance. To re-establish benefits, you will need to reapply for SNAP, which may involve going through the entire application process again, including providing documentation and undergoing an interview.

This can create a gap in food assistance and cause hardship. For example, a single parent who misses the deadline may struggle to provide meals for their children until their application is approved again, which can take time.

Renewing SNAP Benefits

Renewal is the process of maintaining your SNAP benefits by completing the necessary steps to ensure continued eligibility. It’s a critical process to avoid any interruption in your food assistance.The steps involved in renewing SNAP benefits closely mirror the recertification process:

- You will receive a renewal notice from the DSS.

- You will be required to complete a renewal form. This form is similar to the initial application and recertification forms, requiring updated information about your household.

- Documentation will be necessary to support the information provided on the renewal form.

- An interview with a DSS caseworker may be required.

- Prompt responses to any requests for information from the DSS are essential.

It’s crucial to respond promptly to all communications from the DSS regarding recertification or renewal. Keep your contact information updated with the DSS to ensure you receive important notices and avoid any disruption in your SNAP benefits.

Contact Information and Resources

Navigating the Food Stamp program, officially known as the Supplemental Nutrition Assistance Program (SNAP) in Connecticut, requires access to reliable information and support. This section provides essential contact details and links to resources designed to assist individuals and families in understanding their eligibility, accessing benefits, and connecting with community support systems.

Connecticut Department of Social Services Contact Information

The Connecticut Department of Social Services (DSS) is the primary agency responsible for administering SNAP benefits. Contacting the DSS is crucial for any questions, application status inquiries, or reporting changes in circumstances.The following are ways to reach the DSS:

- DSS Phone Number: 1-855-6-CONNECT (1-855-626-6632). This toll-free number connects individuals with DSS representatives who can provide assistance.

- DSS Website: The official DSS website is a comprehensive resource for information, applications, and updates. It is a critical tool for accessing program details and resources.

- Local DSS Offices: DSS operates local offices throughout Connecticut. Visiting a local office allows for in-person assistance and direct communication with program staff.

Online Resources for SNAP in Connecticut

The internet offers a wealth of information regarding SNAP in Connecticut. Leveraging online resources is a convenient way to stay informed and manage your benefits.Accessing online resources provides convenience and efficiency.

- Connecticut Department of Social Services Website: The DSS website (www.ct.gov/dss) is the official source for SNAP information. It includes application forms, eligibility guidelines, benefit amounts, and contact information. The website is frequently updated with the latest news and program changes.

- MyCase CT: MyCase CT is an online portal where individuals can manage their SNAP benefits, check their application status, report changes, and communicate with the DSS. This system provides a streamlined way to interact with the program.

- 2-1-1 Infoline: 2-1-1 is a free, confidential service that connects individuals with health and human service programs, including food assistance. This service can provide referrals to local food banks, pantries, and other resources.

Community Resources for SNAP Recipients

Beyond the DSS, a network of community resources supports SNAP recipients. These resources provide additional assistance and support to help individuals and families thrive.Community resources offer crucial support to SNAP recipients.

- Food Banks and Pantries: Food banks and pantries provide supplemental food assistance to individuals and families in need. They often offer a variety of food items, including fresh produce, canned goods, and non-perishable items.

- Farmers’ Markets: Many farmers’ markets in Connecticut accept SNAP benefits through the Electronic Benefit Transfer (EBT) card. This allows recipients to purchase fresh, local produce directly from farmers.

- Community Kitchens: Community kitchens provide prepared meals to individuals and families who may not have the resources to cook their own meals. These kitchens often serve nutritious meals in a supportive environment.

- Nutrition Education Programs: These programs teach individuals and families about healthy eating habits, meal planning, and budgeting. These programs can help SNAP recipients make the most of their benefits.

Wrap-Up

So there you have it, a chill guide to food stamp eligibility calculator CT! You’ve got the basics, the insider tips, and the resources to get you started. Remember, getting help is nothing to be ashamed of – it’s about taking care of yourself and your fam. Now go forth, apply with confidence, and maybe even use those extra funds to treat yourself to some delish Bali-inspired eats.

Peace out!