Sysco vs US Foods, a battle of titans in the food distribution landscape, immediately captures the attention. This examination delves into the intricate ecosystems of these two behemoths, exploring their histories, operational strategies, and financial performances. The competitive dynamics of Sysco and US Foods, a tale of acquisitions, geographical expansion, and customer segmentation, promises a narrative of strategic maneuvers and market dominance.

The analysis will trace the roots of Sysco and US Foods, from their respective foundings to their current global presence. We will dissect their distribution models, comparing their approaches to inventory management, menu planning, and online ordering. Furthermore, the financial performance of each company will be scrutinized, examining revenue streams, market capitalization, and key financial metrics to understand their positions within the industry.

Company Overview: Sysco vs. US Foods

Ayo dunsanak, mari kito caliak labiah dakek duo raksasa dalam industri distribusi makanan, Sysco jo US Foods. Kito akan mancaliak sijarahnyo, wilayah operasinyo, sarato produk-produk utamanyo. Iko indak hanyo tantang parusahaan, tapi tantang caro makanan sampai ka meja makan kito.

Sysco: Sijarah Singkek

Sysco, singkatan dari “Systems and Services Company,” didirian pado taun 1969 di Houston, Texas. Perusahaan ko dimulai jo visi untuak manyadiokan solusi distribusi makanan nan efisien.

- 1970-an: Sysco mangalami pertumbuhan nan capek, mambuek akuisisi babagai parusahaan distribusi lokal untuak maluehan jangkauannyo.

- 1980-an: Sysco manjadi parusahaan publik dan taruih mangembangkan jaringan distribusinyo di saluruah Amerika Serikat.

- 1990-an sampai kini: Sysco malakukan ekspansi internasional, mamasuaki pasar di Kanada, Eropa, jo wilayah lainnyo. Kini, Sysco adolah salah satu distributor makanan paliang gadang di dunia.

US Foods: Awal Mulo jo Perkembangan Penting

US Foods, sabaliaknyo, mamiliki sijarah nan labiah kompleks. US Foods bukanlah parusahaan nan didirian dari awal, tapi marupoan hasil dari banyak merger jo akuisisi.

- Awal 1900-an: Babagai parusahaan distribusi makanan mandirikan cikal bakal US Foods.

- 2000-an: Usaho-usaho konsolidasi nan gadang, tamasuak merger antaro parusahaan-parusahaan distribusi makanan nan babagai, mambantuak US Foods nan kito kenal kini. Akuisisi signifikan taruih tajadi.

- Kini: US Foods taruih baoperasi sabagai distributor makanan gadang, malayani restoran, rumah sakik, jo institusi lainnyo.

Jangkauan Geografis: Dimano Mereka Baroperasi

Kito caliak dimano Sysco jo US Foods mancubo mancapai palanggan-palanggan mereka.

- Sysco: Sysco mamiliki operasi di Amerika Serikat, Kanada, Inggris, Irlandia, Perancis, Swedia, jo Bahama.

- US Foods: US Foods utamonyo baoperasi di Amerika Serikat.

Perbandingan: Tabel Ringkasan

Untuak labiah jaleh, kito caliak tabel perbandingan antaro Sysco jo US Foods:

| Company | Founded | Headquarters | Key Products |

|---|---|---|---|

| Sysco | 1969 | Houston, Texas, Amerika Serikat | Daging, makanan laut, produk susu, sayua-sayuran, makanan beku, peralatan dapur, jo produk non-makanan. |

| US Foods | Hasil dari merger babagai parusahaan distribusi makanan | Rosemont, Illinois, Amerika Serikat | Daging, makanan laut, produk susu, sayua-sayuran, makanan beku, produk kaleng, jo produk non-makanan. |

Business Model Comparison: Sysco Vs Us Foods

Ado bana, mari kito bahas perbandingan model bisnis antaro Sysco jo US Foods. Kito caliak apo nan mambedakan caro karajo kaduo parusahaan gadang ko, sarato baa inyo malayani palanggan sarato manyadioan produk-produk makanan.

Distribution Network of Sysco

Sysco mampunyoi jaringan distribusi nan sangaik kuek, iyolah tulang pungguang dari model bisnisnyo.Sysco mamiliki jaringan distribusi nan sangaik laweh, maliputi gudang-gudang nan strategis talatak di saluruah Amerika Sarikat jo sapanjang dunia. Gudang-gudang ko berfungsi sabagai pusek distribusi, tampek produk-produk makanan disimpanan, diproses, jo disiapkan untuak dikirim ka palanggan. Pado dasarnyo, Sysco mamiliki hub-and-spoke model, jo gudang-gudang sabagai “hub” nan malayani “spokes” atau daerah-daerah di mano palanggan barado.* Jaringan Distribusi: Sysco mamiliki labiah dari 330 pusek distribusi di saluruah dunia.

Jaringan ko mampamudahkan inyo untuak manyadioan layanan ka palanggan di sadoalah wilayah.

Teknologi

Sysco manggunokan teknologi nan canggih dalam pangalolaan rantai pasokan, tamasuak sistem pangaturan gudang, palacakan armada, jo pangalolaan inventaris. Hal iko mambantu inyo mangurangi biaya, maningkekan efisiensi, jo mampacapek pangiriman.

Efisiensi

Jo jaringan distribusi nan laweh jo teknologi nan canggih, Sysco dapek mangirimkan produk-produk makanan ka palanggan sacaro efisien, mampunyoi tingkat palayanan nan tinggi, jo mampatahanan standar kualitas nan konsisten.

US Foods’ Approach to Food Distribution

US Foods juo mamiliki pendekatan nan kuek dalam distribusi makanan, jo fokus pado babarapo aspek nan mambedakannyo.US Foods mampunyoi jaringan distribusi nan kuek, sarupo Sysco, tapi inyo mampunyoi babarapo kalabiahan nan mambedakannyo. Salain itu, US Foods juo manarapkan strategi nan fokus pado palanggan, manawarkan layanan nan dipasan sasuai jo kabutuahan palanggan.* Fokus Palanggan: US Foods mampunyoi fokus nan kuek pado palanggan, manawarkan solusi nan dipasan sasuai jo kabutuahan palanggan.

Iko tamasuak layanan konsultasi menu, pangembangan resep, jo dukungan pemasaran.

Jaringan Distribusi

US Foods mamiliki labiah dari 70 pusek distribusi di saluruah Amerika Sarikat.

Inovasi

US Foods taruih bainovasi, manawarkan produk-produk baru jo solusi nan inovatif untuak mamanuhi parmintaan palanggan. Contohnyo, inyo mampakenalan produk-produk nan ramah lingkungan jo solusi pangurangan limbah makanan.

Customer Segments Served by Each Company

Kaduonyo Sysco jo US Foods malayani babagai macam segmen palanggan, tapi ado babarapo parbedaan nan manarik.Kaduo parusahaan ko mampunyoi daftar palanggan nan laweh, tamasuak restoran, rumah sakik, sakolah, jo banyak lai. Namun, ado babarapo parbedaan dalam fokus palanggan.* Sysco: Sysco cenderung malayani palanggan gadang jo skala nan labiah gadang, tamasuak rantai restoran nasional jo internasional, rumah sakik gadang, jo lembaga pandidikan gadang.

US Foods

US Foods labiah fokus pado palanggan lokal jo regional, tamasuak restoran independen, restoran cepat saji, jo palanggan nan labiah ketek. US Foods juo mampunyoi fokus nan kuek pado segmen palanggan “mid-market”.

Perbandingan

Check what professionals state about chinese food in spring texas and its benefits for the industry.

Sysco mampunyoi jangkauan global nan labiah laweh, samantaro US Foods labiah fokus pado pasar domestik.

Product Portfolios of Both Companies

Jinih produk nan ditawarkan kaduo parusahaan ko juo mambedakan karajo.Kaduo parusahaan ko manawarkan babagai macam produk makanan, tapi ado babarapo parbedaan dalam fokus jo spesialisasi.* Sysco: Sysco manawarkan portofolio produk nan sangaik laweh, maliputi babagai macam produk makanan, minuman, jo produk non-makanan. Inyo mampunyoi spesialisasi dalam produk-produk segar, beku, jo kering.

US Foods

US Foods juo manawarkan portofolio produk nan laweh, tapi inyo labiah fokus pado produk-produk nan manjadi ciri khasnyo, sarupo produk-produk bermerek pribadi jo produk-produk khusus. Inyo juo manawarkan produk-produk nan dipasan sasuai jo kabutuahan palanggan.

Perbandingan

Sysco manawarkan labiah banyak pilihan produk, samantaro US Foods labiah fokus pado produk-produk khusus jo merek pribadi.

Services Offered by Sysco and US Foods

Salain manyadioan produk, kaduo parusahaan ko juo manawarkan babagai macam layanan untuak mambantu palanggan.Kaduo parusahaan ko manawarkan babagai macam layanan untuak mambantu palanggan, tamasuak:* Inventory Management: Kaduonyo manawarkan layanan pangalolaan inventaris untuak mambantu palanggan mangontrol stok jo mangurangi limbah.

Menu Planning

Kaduonyo manawarkan layanan parancanaan menu untuak mambantu palanggan mambuek menu nan manarik jo efisien.

Online Ordering

Kaduonyo manawarkan platform pemesanan online untuak mampamudahkan palanggan mambuek pesanan.

Layanan Tambahan Lainnyo

Kaduonyo manawarkan layanan tambahan sarupo dukungan pemasaran, pangembangan resep, jo pelatihan staf.

Financial Performance

Ondeh, in the world of big-time food distribution, the financial health of Sysco and US Foods is what really matters. It’s like seeing how well a warung is doing – are they making enough money to keep the business going strong? Let’s delve into the numbers and see how these giants are faring.The success of these companies isn’t just about selling food; it’s about how well they manage their money, and that’s what we’re going to explore.

Revenue Streams for Sysco

Sysco’s revenue comes from a few main places. They sell food products, of course, but it’s not as simple as just that. Over the past five years, things have changed, and we’ll see how.

- Food Products: This is the biggest chunk, including things like meat, produce, frozen foods, and canned goods. It’s the bread and butter, or rather, the nasi and gulai, of their business.

- Sales to Restaurants: Restaurants are a major customer. Sysco provides them with almost everything they need to run their kitchens.

- Sales to Healthcare and Education: They also sell to hospitals, schools, and other institutions. This provides a stable source of income.

- Sales to Lodging: Hotels and resorts also need a lot of food, and Sysco caters to them as well.

- Recent Changes: Over the last five years, Sysco has focused on growing its market share, especially by acquiring smaller distributors to expand its reach. This strategic move has led to an increase in revenue, although economic conditions and inflation have impacted profitability at times.

Revenue Sources for US Foods

US Foods has similar revenue sources, but the details are a little different. Their financial performance tells its own story.

- Food Products: Like Sysco, this is their primary source of income. They provide a wide array of food products to their customers.

- Sales to Restaurants: This is a very important segment for US Foods. They work with all kinds of restaurants, from small, independent places to large chains.

- Sales to Healthcare and Education: Similar to Sysco, they also supply food to hospitals, schools, and other institutions.

- Sales to Hospitality: US Foods also serves hotels, resorts, and other lodging facilities.

- Trends in Financial Performance: US Foods has shown growth, although its growth rate may fluctuate based on the overall economy. They’ve focused on increasing sales and managing costs, aiming for improved profitability. Their performance is sensitive to inflation and supply chain issues.

Market Capitalization Comparison

Market capitalization is the total value of a company’s outstanding shares. It’s a quick way to see how big a company is.

- Sysco: Generally, Sysco has a larger market capitalization than US Foods. As of October 26, 2023, Sysco’s market capitalization was approximately $39 billion.

- US Foods: US Foods has a market capitalization that is typically smaller than Sysco’s. As of October 26, 2023, US Foods’ market capitalization was approximately $6.8 billion.

- Impact: A higher market capitalization can give a company more flexibility in raising capital and making acquisitions.

Key Financial Metrics

To understand how well Sysco and US Foods are doing, we need to look at some key numbers.

- Gross Margin: This is the percentage of revenue left after deducting the cost of goods sold. It shows how efficiently a company is managing its production costs.

- Operating Income: This is the profit a company makes from its core business operations. It’s what’s left after deducting operating expenses like salaries and rent.

- Net Income: This is the “bottom line” – the profit a company makes after all expenses, including taxes, are deducted.

- Operating Margin: This is operating income divided by revenue. It shows how efficiently a company is turning sales into profit from its operations.

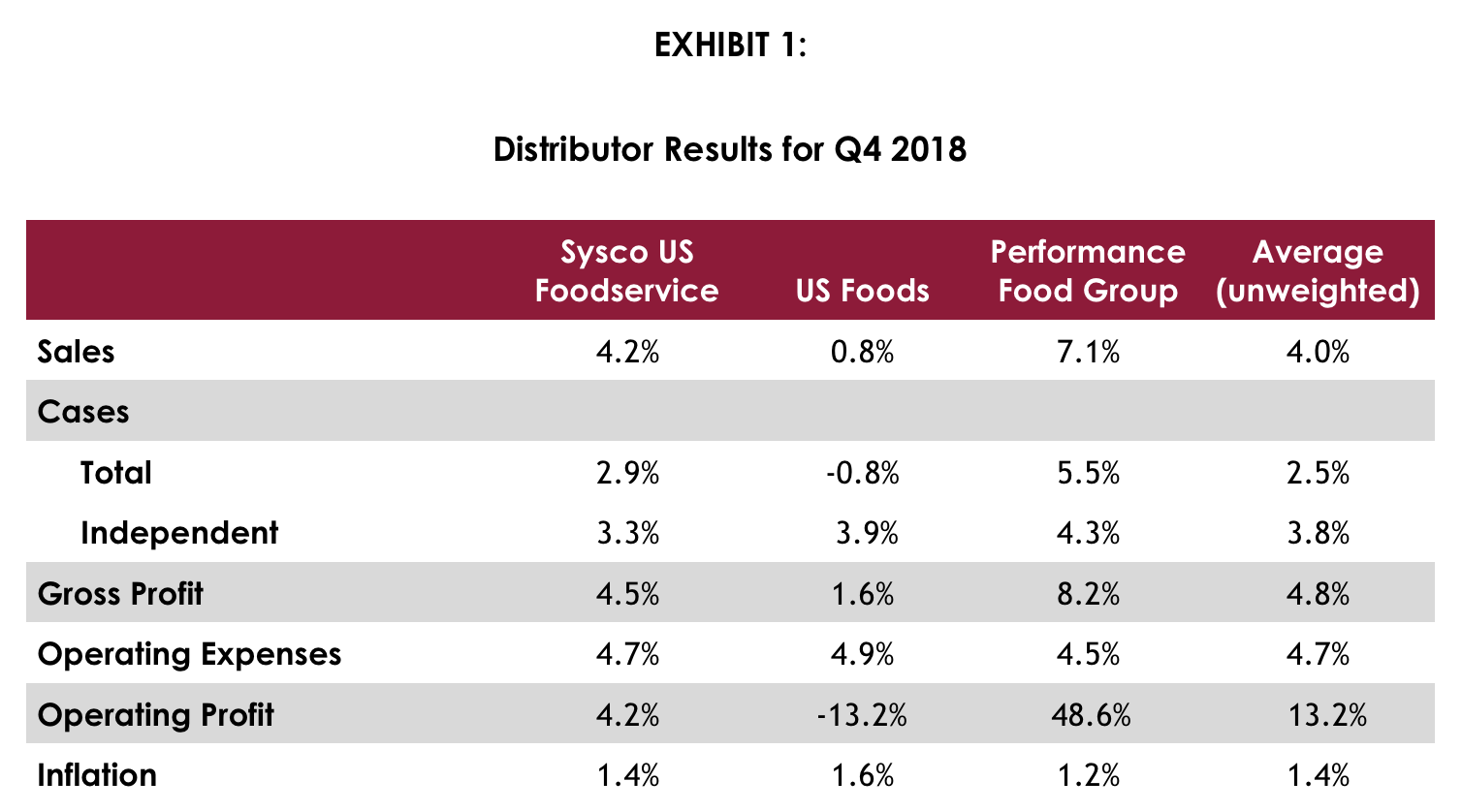

Financial Performance Comparison Table, Sysco vs us foods

Here’s a comparison of Sysco and US Foods’ financial performance over the last three fiscal years. Remember, these are just snapshots and numbers can change.

| Metric | Sysco (Fiscal Year Ending June) | US Foods (Fiscal Year Ending December) | |

|---|---|---|---|

| 2022 | 2022 | ||

| Revenue (USD Billions) | $76.1 | $34.1 | |

| Net Income (USD Billions) | $1.7 | $0.2 | |

| Operating Margin | 3.8% | 2.4% | |

| 2021 | 2021 | ||

| Revenue (USD Billions) | $51.3 | $28.3 | |

| Net Income (USD Billions) | $0.8 | $0.1 | |

| Operating Margin | 3.0% | 1.8% | |

| 2020 | 2020 | ||

| Revenue (USD Billions) | $52.8 | $22.8 | |

| Net Income (USD Billions) | $(0.3) | $(0.3) | |

| Operating Margin | 1.7% | (0.1%) |

Closure

In conclusion, the narrative of Sysco vs US Foods reveals a complex interplay of strategic decisions and market adaptations. From humble beginnings to global reach, these companies have shaped the food distribution industry. Their ongoing competition, fueled by evolving consumer demands and technological advancements, promises a dynamic future. The examination of their models offers insights into the challenges and opportunities that define the food distribution sector.