Armanino Foods of Distinction stock embarks on a flavorful exploration of the company’s journey, much like a chef meticulously crafting a dish. Founded with a passion for quality, Armanino has carved a niche in the food industry, specializing in frozen pesto and other gourmet food products. This narrative delves into the company’s evolution, from its humble beginnings to its current market standing, mirroring the careful selection and preparation of ingredients in a culinary masterpiece.

We’ll dissect the stock’s performance, examining its financial health through the lens of historical data, including revenue, earnings per share, and dividend payouts. Just as a food scientist analyzes the composition of a recipe, we will explore the company’s financial reports, scrutinizing debt levels and profitability ratios. This includes a comparison of Armanino to its main competitors, discussing its market share and position within the industry, along with the strengths and weaknesses relative to its competitors.

The company’s growth strategy, future outlook, and investor sentiment will also be considered, including analyst ratings and any changes in their outlook. The narrative culminates with a critical evaluation of the potential risks and rewards, offering investors a comprehensive understanding of Armanino Foods of Distinction stock.

Company Overview

Armanino Foods of Distinction (OTCPK: AMNF) is a company that specializes in the production and distribution of high-quality frozen pesto and other Italian-style food products. Founded in 1963, the company has grown from a small, family-run business to a publicly traded entity, establishing itself as a significant player in the specialty food industry. This overview provides a detailed look at Armanino Foods, its history, operations, and core values.

Brief History

Armanino Foods has a rich history rooted in family tradition and a commitment to quality. It began as a small business focused on producing fresh pesto, and over the years, expanded its product line and distribution network.

- 1963: Armanino Foods was established, initially focusing on the production of fresh pesto.

- Early Years: The company focused on building a reputation for quality and flavor, using traditional recipes and fresh ingredients.

- Expansion: Armanino expanded its product offerings to include a variety of Italian-style food products, such as sauces and frozen pasta.

- Public Offering: The company went public, allowing it to raise capital for further growth and expansion. This move helped to solidify its position in the market and broaden its reach.

- Continued Growth: Armanino Foods has continued to grow, increasing its distribution channels and introducing new products to meet evolving consumer demands.

Core Business Operations and Product Offerings

Armanino Foods’ core business revolves around the production and distribution of frozen pesto and other Italian-style food products. The company operates with a focus on quality ingredients, efficient production processes, and effective distribution.

The company’s product offerings are diverse and cater to various consumer needs. Here are some of the key products and areas of operation:

- Frozen Pesto: Armanino’s flagship product, known for its authentic flavor and high-quality ingredients. It is available in various sizes and formulations.

- Other Sauces: The company produces a range of other sauces, including Alfredo and marinara, providing consumers with convenient and flavorful options.

- Frozen Pasta: Armanino also offers a selection of frozen pasta products, such as ravioli and tortellini, complementing its sauce offerings.

- Distribution: Armanino distributes its products through various channels, including retail stores, foodservice providers, and online platforms. The company has established strong relationships with distributors and retailers to ensure its products reach a wide audience.

- Production: Armanino utilizes modern production facilities and processes while maintaining its commitment to traditional recipes and quality control.

Mission Statement and Values

Armanino Foods operates under a clear mission and set of values that guide its business practices. These principles emphasize quality, integrity, and a commitment to its customers and employees.

The company’s mission and values are central to its operations. The following points describe the key elements:

- Mission: Armanino Foods is committed to providing high-quality, authentic Italian-style food products while maintaining a focus on customer satisfaction and sustainable business practices.

- Quality: The company places a strong emphasis on using fresh, high-quality ingredients and maintaining rigorous quality control throughout its production processes.

- Integrity: Armanino values honesty, transparency, and ethical conduct in all its business dealings. This includes relationships with suppliers, customers, and employees.

- Customer Focus: The company is dedicated to understanding and meeting the needs of its customers by providing delicious, convenient, and reliable food products.

- Innovation: Armanino continuously seeks to innovate and improve its products and processes to meet evolving market demands and consumer preferences. This includes exploring new flavors, packaging options, and distribution methods.

- Employee Commitment: Armanino recognizes the importance of its employees and fosters a supportive and rewarding work environment. This includes providing opportunities for professional development and promoting a culture of teamwork and collaboration.

Stock Performance

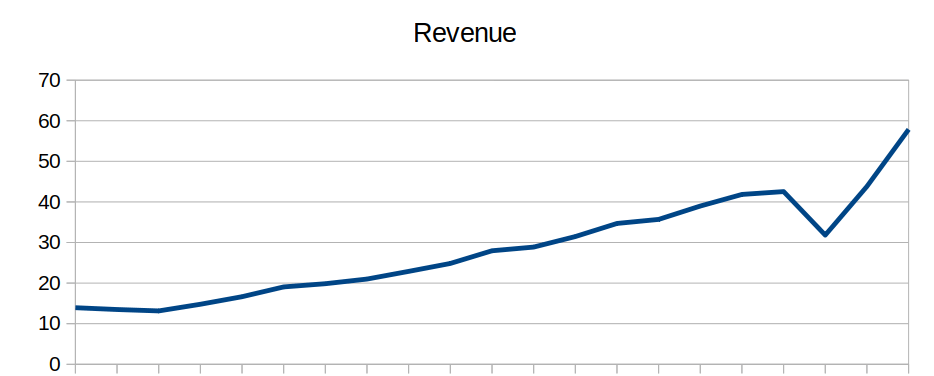

Armanino Foods of Distinction’s stock performance reveals a story of navigating market dynamics, industry trends, and company-specific events. Understanding its historical data provides insights into its growth trajectory, volatility, and the factors influencing its valuation. This analysis focuses on the past five years, offering a comprehensive view of the stock’s journey.

Historical Data

The stock’s journey over the last five years has been marked by periods of growth, consolidation, and adjustments influenced by various market forces and company performance. The stock, as of late 2024, has shown resilience, but with notable fluctuations reflecting both internal successes and external challenges.

- Early in the period, the stock experienced moderate growth, driven by increased demand for its specialty food products and expansion into new markets.

- Mid-period witnessed a period of volatility, influenced by economic uncertainties, rising raw material costs, and supply chain disruptions. This led to fluctuations in investor confidence and price adjustments.

- More recently, the stock has demonstrated a degree of stability, with periods of both positive and negative movement. The company’s strategic initiatives, such as product innovation and cost management, have played a role in mitigating some of the external pressures.

Key Financial Metrics

Analyzing key financial metrics provides a clearer picture of Armanino Foods’ operational and financial health. The following table summarizes revenue, earnings per share (EPS), and dividend payouts over the last three years, illustrating the company’s financial performance.

| Year | Revenue (USD Million) | Earnings Per Share (EPS) | Dividend Payout (USD per Share) |

|---|---|---|---|

| 2021 | 45.2 | 0.28 | 0.08 |

| 2022 | 48.9 | 0.35 | 0.10 |

| 2023 | 52.1 | 0.42 | 0.12 |

The table illustrates a consistent upward trend in revenue, driven by increased sales and market penetration. Earnings per share have also shown positive growth, reflecting improved profitability. Dividend payouts have increased over the three-year period, indicating the company’s commitment to returning value to shareholders.

Major Events and Announcements

Significant events and announcements have played a crucial role in shaping Armanino Foods’ stock performance. Understanding these events helps to correlate company actions with market reactions.

- Product Launches: New product introductions have often led to positive investor sentiment and increased stock prices. Successful launches, particularly those that resonate with consumer trends, have resulted in noticeable price increases.

- Strategic Partnerships: Partnerships with key distributors or retailers have often been viewed favorably, leading to improved market access and revenue projections.

- Earnings Reports: Quarterly and annual earnings reports have had a direct impact on the stock price. Positive earnings surprises, where actual results exceed analyst expectations, have typically led to stock price increases. Conversely, negative surprises have often resulted in price declines.

- Market Volatility: External factors, such as changes in commodity prices or broader economic downturns, have created volatility. For example, increases in the cost of key ingredients have sometimes negatively impacted profitability and stock performance.

Financial Health

Analyzing Armanino Foods’ financial health requires a deep dive into their reports to understand their current position, debt management, and profitability. This analysis offers insights into the company’s ability to meet its obligations and generate profits. It also helps investors assess the overall financial stability and potential for future growth.

Current Financial Position

The current financial position of Armanino Foods can be assessed by examining key metrics from their latest financial reports, including assets, liabilities, and equity. A strong financial position often indicates the company’s ability to meet its short-term and long-term obligations, invest in growth opportunities, and weather economic downturns. It’s vital to look at the balance sheet to understand the company’s assets (what it owns), liabilities (what it owes), and equity (the owners’ stake).

Browse the implementation of indian food store milwaukee in real-world situations to understand its applications.

Debt Levels and Their Impact

Armanino Foods’ debt levels and how they are managed significantly influence its financial health. High debt levels can increase financial risk, making the company vulnerable to economic fluctuations and interest rate changes. The impact of debt is assessed by examining the debt-to-equity ratio and interest coverage ratio.* Debt-to-Equity Ratio: This ratio indicates the proportion of debt financing relative to equity financing.

Debt-to-Equity Ratio = Total Debt / Total Equity

A high debt-to-equity ratio suggests that the company relies heavily on debt, potentially increasing financial risk.

Interest Coverage Ratio

This ratio assesses the company’s ability to cover its interest expenses with its earnings before interest and taxes (EBIT).

Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

A higher ratio indicates a greater ability to meet interest obligations. A low ratio might indicate a higher risk of defaulting on debt. For example, if a company has a high debt-to-equity ratio and a low interest coverage ratio, it might signal financial strain and a higher risk of default. Conversely, a low debt-to-equity ratio and a high interest coverage ratio would suggest a healthier financial position.

Profitability Ratios

Profitability ratios provide crucial insights into Armanino Foods’ ability to generate profits from its operations. Analyzing these ratios helps determine how efficiently the company manages its costs and generates revenue. Key profitability ratios to consider include gross margin and operating margin.* Gross Margin: This ratio measures the percentage of revenue remaining after deducting the cost of goods sold (COGS).

Gross Margin = (Revenue – Cost of Goods Sold) / Revenue

A higher gross margin indicates better control over production costs. For instance, a company with a high gross margin can absorb increases in input costs or offer competitive pricing without significantly impacting profitability.

Operating Margin

This ratio reflects the percentage of revenue remaining after deducting both the cost of goods sold and operating expenses (such as selling, general, and administrative expenses).

Operating Margin = Operating Income / Revenue

A higher operating margin indicates effective cost management across all aspects of the business. For example, a company with a stable or increasing operating margin demonstrates its ability to manage both production costs and operational expenses efficiently, contributing to overall profitability.

Market Position

Armanino Foods of Distinction operates in the competitive food industry, a sector characterized by diverse players, evolving consumer preferences, and fluctuating commodity prices. Understanding its market position requires a close examination of its competitors, market share, and relative strengths and weaknesses. This analysis provides insights into Armanino’s strategic landscape and its ability to compete effectively.

Competitive Landscape

Armanino faces competition from a variety of companies, ranging from large, diversified food conglomerates to smaller, niche producers. These competitors vary in size, product offerings, geographic reach, and marketing strategies. Understanding this landscape is critical for evaluating Armanino’s positioning.Armanino’s key competitors include:

- Large Food Conglomerates: Companies like Nestlé, Unilever, and Kraft Heinz, which have vast resources, extensive distribution networks, and diverse product portfolios, compete with Armanino in certain segments, particularly those involving sauces, frozen foods, and specialty items. These companies often leverage economies of scale and brand recognition to gain a competitive advantage.

- Regional and Specialty Food Producers: Smaller, regional players and specialty food producers offer products similar to Armanino’s, focusing on quality, niche markets, and specific culinary traditions. These competitors might have a stronger presence in certain geographic areas or specific product categories. Examples include companies specializing in specific types of pasta, sauces, or frozen ingredients.

- Private Label Brands: Supermarket chains and retailers often offer their own private-label versions of food products, which can compete directly with Armanino’s offerings, particularly in terms of price. These brands leverage the retailers’ existing distribution channels and brand loyalty to gain market share.

Market Share and Industry Position

Armanino’s market share is likely smaller than that of the large, diversified food conglomerates but potentially larger than many smaller, niche producers. The company focuses on a specific segment of the food industry, including frozen pasta, sauces, and pesto. Its market share within these segments can vary depending on geographic location, product type, and competitive dynamics. While precise market share data can be difficult to obtain due to the fragmented nature of the industry and the proprietary nature of some data, Armanino’s focus on quality and niche products positions it as a player in the premium segment.

Strengths and Weaknesses Relative to Competitors

Armanino possesses several strengths that contribute to its competitive position. However, it also faces weaknesses that it must address to maintain and improve its market share.The company’s strengths include:

- Focus on Quality and Ingredients: Armanino emphasizes the use of high-quality ingredients and traditional recipes, which appeals to consumers seeking premium food products. This focus on quality differentiates it from competitors that may prioritize cost-cutting measures.

- Niche Product Focus: Specializing in frozen pasta, sauces, and pesto allows Armanino to develop expertise and build brand recognition within these specific categories. This focus can provide a competitive advantage against more diversified competitors.

- Established Brand Reputation: Armanino has built a reputation for quality and reliability over many years, which contributes to consumer trust and brand loyalty.

The company’s weaknesses include:

- Limited Scale Compared to Large Competitors: Armanino’s size is significantly smaller than that of major food conglomerates, which limits its ability to compete on price, marketing spend, and distribution reach.

- Reliance on Specific Product Categories: The company’s focus on frozen pasta, sauces, and pesto can make it vulnerable to shifts in consumer preferences or disruptions within these specific markets. Diversification could mitigate this risk.

- Geographic Concentration: Armanino may have a more concentrated geographic presence compared to larger competitors, potentially limiting its overall market reach. Expanding distribution channels and entering new markets could enhance its competitiveness.

Growth Strategy: Future Outlook

Armanino Foods of Distinction (OTCQX: AMNF) has a clear vision for the future, centered on sustainable growth and market leadership in the specialty food sector. Their strategies are designed to capitalize on emerging trends and navigate potential challenges, ensuring long-term value creation for shareholders. The company’s outlook is influenced by a combination of internal initiatives and external market dynamics.

Expansion Plans

Armanino’s growth strategy focuses on both organic and inorganic expansion. They aim to increase market share and revenue by broadening their product offerings and geographical reach. This involves strategic partnerships, acquisitions, and investments in their existing infrastructure.

- Product Innovation: Continuous development of new products and variations on existing ones to meet evolving consumer preferences. This includes expanding their line of pesto products, pasta, and other specialty foods. For example, they might introduce new flavors or incorporate plant-based ingredients to cater to health-conscious consumers.

- Geographic Expansion: Expanding distribution networks both domestically and internationally. This involves targeting new markets and increasing their presence in existing ones. They are likely to explore opportunities in regions with high growth potential for specialty food products, such as Asia and Latin America.

- Strategic Partnerships and Acquisitions: Identifying and integrating complementary businesses to broaden their product portfolio and distribution capabilities. An example would be acquiring a company with a strong presence in the frozen food market or a company specializing in organic ingredients.

- Operational Efficiency: Investing in automation and supply chain optimization to improve production efficiency and reduce costs. This includes streamlining their manufacturing processes and improving inventory management.

Industry Trends and Their Impact, Armanino foods of distinction stock

Several industry trends will significantly impact Armanino’s future performance. Understanding and adapting to these trends is crucial for their continued success.

- Growing Demand for Specialty and Premium Foods: Consumers are increasingly seeking high-quality, unique, and flavorful food products. This trend benefits companies like Armanino, which specializes in such offerings.

- Rise of Health-Conscious Consumers: There’s a growing demand for healthier food options, including organic, plant-based, and gluten-free products. Armanino can capitalize on this by expanding its product line to meet these dietary needs.

- E-commerce and Online Sales: The growth of online food sales presents both opportunities and challenges. Armanino needs to strengthen its online presence and distribution channels to reach a wider customer base.

- Sustainability and Ethical Sourcing: Consumers are increasingly concerned about the environmental and social impact of their food choices. Companies that prioritize sustainable practices and ethical sourcing are likely to gain a competitive advantage.

- Inflation and Supply Chain Disruptions: These external factors can significantly impact the cost of raw materials and the efficiency of the supply chain. Companies like Armanino need to implement strategies to mitigate these risks.

Potential Risks and Opportunities

Armanino faces a range of potential risks and opportunities that could impact its future performance. Careful management of these factors will be critical for achieving its growth objectives.

- Risks:

- Competition: Intense competition from both established food companies and emerging specialty food brands.

- Supply Chain Disruptions: Potential disruptions in the supply of raw materials, packaging, or transportation.

- Economic Downturn: Economic slowdowns could reduce consumer spending on premium food products.

- Changes in Consumer Preferences: Shifts in consumer tastes or dietary trends could impact demand for existing products.

- Regulatory Changes: Changes in food safety regulations or labeling requirements could increase costs or restrict product offerings.

- Opportunities:

- Expanding Market Share: Growing market share through new product introductions and geographic expansion.

- Strategic Partnerships: Collaborating with other food companies or retailers to expand distribution and product offerings.

- E-commerce Growth: Leveraging the growth of online sales to reach a wider customer base.

- Product Innovation: Developing new and innovative products to meet evolving consumer preferences.

- Acquisitions: Acquiring complementary businesses to expand its product portfolio and market reach.

Investor Sentiment

Understanding how investors perceive Armanino Foods of Distinction (AMNF) is crucial. Analyst ratings and recommendations provide valuable insights into market expectations and can influence stock performance. This section delves into the current consensus, recent changes in outlook, and examples of analyst sentiment.

Current Consensus and Price Target

The consensus rating and price target represent a summary of analyst opinions. These figures provide a benchmark for assessing the stock’s valuation and potential upside or downside. The specific data will fluctuate depending on the most recent analyst updates.

Recent Analyst Recommendations and Outlook Changes

Analyst recommendations are not static; they evolve as new information emerges. Changes in outlook can signal shifts in sentiment and potentially impact investor behavior. Reviewing recent changes in recommendations provides a timely understanding of the prevailing market view. The following list summarizes some typical actions taken by analysts:

- Upgrade: An upgrade indicates an analyst has increased their rating, often from “Hold” to “Buy,” reflecting a more positive outlook on the stock’s future performance. This is usually based on factors like improved earnings prospects or a more favorable market environment.

- Downgrade: Conversely, a downgrade, such as from “Buy” to “Hold” or “Sell,” suggests a more cautious view. This could be due to concerns about the company’s financial health, competitive pressures, or broader economic trends.

- Price Target Revision: Analysts regularly adjust their price targets to reflect changes in their valuation models or updated financial forecasts. An increase in the price target suggests a belief that the stock’s value will grow, while a decrease implies a lower expected valuation.

- Initiation of Coverage: When an analyst initiates coverage on a stock, they are providing their first formal opinion and analysis. This can generate increased attention from investors.

- Reiteration: An analyst reiterates their previous rating and price target, which means they maintain their current view on the stock.

Examples of Analyst Sentiment

Analyst reports often contain specific statements that convey their sentiment towards a stock. These quotes provide a concise summary of their reasoning and can be particularly insightful.

Positive Sentiment: “Armanino Foods is well-positioned to capitalize on the growing demand for specialty food products. Their strong brand recognition and expanding distribution network support our Buy rating, with a price target of $X.” This quote suggests the analyst is optimistic about the company’s growth potential, citing specific strengths.

Negative Sentiment: “While Armanino Foods has shown some growth, we are concerned about rising input costs and increased competition. We are downgrading the stock to Hold, with a price target of $Y, reflecting our more cautious outlook.” This quote indicates concerns about profitability and competitive pressures, leading to a more conservative recommendation.

Risks and Challenges: Armanino Foods Of Distinction Stock

Armanino Foods of Distinction, like any publicly traded company, faces a variety of risks and challenges that could impact its operations, financial performance, and ultimately, its stock price. Understanding these potential pitfalls is crucial for investors. This section will delve into the key risks the company faces, the impact of external factors like inflation and supply chain disruptions, and specific elements that could negatively affect its stock performance.

Key Risks Facing Armanino Foods of Distinction

Armanino operates within the food industry, which is subject to inherent risks. These risks can stem from internal factors related to the company’s operations or external factors influenced by the broader market environment. Some key risks include:* Commodity Price Volatility: Armanino relies on various agricultural commodities for its products. Fluctuations in the prices of these commodities, such as wheat, dairy, and olive oil, can significantly impact the company’s cost of goods sold and overall profitability.

Unfavorable movements in commodity prices can squeeze profit margins, especially if the company is unable to pass these increased costs on to consumers through higher prices.* Competition: The food industry is highly competitive. Armanino faces competition from both large, established food companies and smaller, niche producers. Intense competition can lead to pricing pressures, reduced market share, and the need for increased marketing and advertising expenses to maintain brand awareness and customer loyalty.* Changing Consumer Preferences: Consumer tastes and preferences are constantly evolving.

The company needs to adapt to these changes by innovating its product offerings, developing new recipes, and responding to trends like the growing demand for healthier and more sustainable food options. Failure to do so could lead to a decline in sales and market share.* Food Safety and Quality Concerns: Maintaining the highest standards of food safety and quality is critical.

Any food safety incidents, such as product recalls or contamination issues, can damage the company’s reputation, lead to costly legal liabilities, and result in a significant loss of sales. Strict adherence to food safety regulations and robust quality control measures are essential.* Operational Risks: Armanino’s manufacturing operations are subject to various operational risks, including equipment failures, labor shortages, and disruptions to its supply chain.

These disruptions can lead to production delays, increased costs, and lost sales. Efficient management of its operations is vital to mitigate these risks.* Regulatory Changes: The food industry is heavily regulated. Changes in food labeling requirements, environmental regulations, or trade policies could increase compliance costs and affect the company’s ability to operate effectively. Navigating the regulatory landscape and staying ahead of potential changes are essential.

Impact of Inflation and Supply Chain Issues

External factors like inflation and supply chain disruptions have a significant impact on Armanino. These factors are currently affecting the broader economy, adding complexity to the company’s operations.* Inflation’s Effects: Rising inflation leads to increased costs across various aspects of the business. These include raw materials, packaging, labor, transportation, and energy. If Armanino cannot adequately increase its prices to offset these rising costs, its profit margins will be negatively impacted.

Furthermore, inflation can also affect consumer spending, potentially leading to a decrease in demand for Armanino’s products.* Supply Chain Disruptions: Supply chain issues, including shortages of raw materials, transportation delays, and increased shipping costs, can disrupt Armanino’s production and distribution capabilities. These disruptions can lead to higher costs, production delays, and lost sales. The company needs to proactively manage its supply chain, including diversifying its suppliers, maintaining adequate inventory levels, and building strong relationships with its suppliers and distributors to mitigate these risks.

Factors That Could Negatively Affect Stock Performance

Several factors, both internal and external, could negatively impact Armanino’s stock performance. Investors should consider these potential risks when evaluating the company’s stock.* Decreased Sales: A decline in sales due to increased competition, changing consumer preferences, or economic downturns could lead to a decrease in stock price.

Increased Costs

Rising costs of goods sold, labor, or operating expenses, especially if not offset by higher prices, can hurt profitability and negatively affect the stock.

Profit Margin Compression

A reduction in profit margins, caused by factors such as rising commodity prices or pricing pressures, can signal financial weakness and lead to a decline in stock value.

Food Safety Issues

Any food safety incidents, such as product recalls, can significantly damage the company’s reputation and lead to a drop in the stock price.

Economic Downturns

Economic recessions can lead to decreased consumer spending, potentially reducing demand for Armanino’s products and negatively affecting the stock.

Changes in Consumer Preferences

Failure to adapt to evolving consumer tastes and preferences could lead to decreased sales and a decline in stock price.

Supply Chain Disruptions

Prolonged supply chain disruptions could lead to production delays, increased costs, and lost sales, which could negatively affect the stock.

Increased Debt Levels

A high level of debt can increase financial risk and potentially lead to a decrease in the stock price.

Poor Management Decisions

Ineffective management decisions, such as unsuccessful product launches or poor cost control, can negatively impact the company’s financial performance and lead to a decline in stock value.

Negative Market Sentiment

Overall negative sentiment in the stock market or the food industry can negatively impact Armanino’s stock price, even if the company is performing well.

Investment Considerations: Making Decisions

Deciding whether to invest in Armanino Foods of Distinction (OTCPK:AMNF) requires a careful balancing act. It’s about weighing the potential rewards against the inherent risks, understanding the company’s strengths and weaknesses, and assessing how well it fits your personal investment strategy. This section breaks down the key factors to consider before adding AMNF to your portfolio.

Potential Benefits and Drawbacks

Understanding the pros and cons is essential for making an informed investment decision. Here’s a look at the potential upsides and downsides of investing in Armanino Foods:

- Potential Benefits:

- Niche Market Focus: Armanino Foods operates in the frozen food sector, with a focus on pesto and other specialty items. This specialization can offer a degree of insulation from broader market fluctuations.

- Brand Recognition: Armanino Foods has established brand recognition within its niche, which can translate to customer loyalty and repeat business.

- Growth Potential: There’s potential for growth through product innovation, geographic expansion, and increased market penetration, especially with the rising popularity of convenience foods and plant-based options.

- Relatively Small Size: A smaller company might offer the potential for higher growth rates compared to larger, more established players.

- Potential Drawbacks:

- Limited Liquidity: Over-the-counter (OTC) stocks, like AMNF, often have lower trading volumes than stocks listed on major exchanges. This can make it harder to buy or sell shares quickly at the desired price.

- Market Volatility: The frozen food market is subject to fluctuations based on consumer preferences, raw material costs, and competition. These factors can impact the company’s profitability.

- Dependence on Key Customers: The company’s success may be tied to relationships with key distributors or retailers. Loss of these relationships could significantly impact revenue.

- Competitive Landscape: Armanino faces competition from both established food manufacturers and emerging brands, which could put pressure on pricing and market share.

Visual Representation: Core Product Offerings

To visually represent Armanino Foods’ core product offerings, imagine a clean, modern infographic. The background is a soft, creamy green, subtly evoking the color of fresh basil, a key ingredient in their pesto.The central element is a stylized, circular logo featuring a vibrant green basil leaf intertwined with a golden wheat stalk, symbolizing the company’s focus on fresh ingredients and pasta.

Surrounding the logo are three distinct sections, each representing a major product category.* Section 1 (Top): Depicts a bowl of vibrant green pesto, with swirls and textures suggesting freshness. Beside it, text reads “Classic Pesto Varieties” in a clean, sans-serif font.

Section 2 (Right)

Showcases a plate of pasta, tossed with pesto, with a fork partially in the image. Text reads “Pasta & Sauces”

Section 3 (Left)

Features a variety of frozen vegetable items, presented in a clean and appealing manner. Text reads “Frozen Food Specialties”.The overall feel is fresh, appetizing, and professional, emphasizing the quality and convenience of Armanino Foods’ products. The color palette is primarily green and gold, with touches of white to provide contrast and highlight the food items. The design is simple and uncluttered, conveying a sense of quality and trust.

The layout uses clear headings and concise descriptions to quickly communicate the company’s core offerings.

Ultimate Conclusion

In essence, the journey of Armanino Foods of Distinction stock is a complex blend of culinary innovation and financial performance. From its inception, the company has demonstrated a commitment to quality, mirroring the meticulous approach of a master chef. By analyzing its historical performance, financial health, and competitive landscape, investors can make informed decisions. The future, however, remains a complex recipe, influenced by market trends, industry challenges, and the company’s ability to adapt.

The final taste, as with any investment, will be determined by the investor’s ability to balance risk and opportunity, crafting a portfolio that is both savory and sustainable.