WV food sales tax is a critical aspect of West Virginia’s financial landscape, and this analysis dives deep into its intricacies. From its historical roots to its current impact, the food sales tax affects every resident, especially those with limited incomes. We will explore its role in generating revenue, its impact on businesses, and the ongoing legislative debates surrounding it.

This examination will dissect the system’s complexities and the implications for the state’s future.

This exploration will dissect the specifics of the WV food sales tax. We will examine the current tax rate, exempt items, and the revenue allocation. The discussion will also consider the impact on consumers, the challenges faced by businesses, and the various legislative attempts to modify the tax. Furthermore, we will compare West Virginia’s system to other states and delve into the economic effects and public opinion surrounding the tax.

This comprehensive analysis aims to provide a clear understanding of this significant tax policy.

Overview of WV Food Sales Tax

West Virginia’s food sales tax is a significant aspect of the state’s revenue generation and affects the cost of living for its residents. Understanding its history, current regulations, and the items it applies to is crucial for both consumers and businesses operating within the state. The following sections will delve into these key components of the West Virginia food sales tax system.

History of the Food Sales Tax in West Virginia

The implementation of a sales tax in West Virginia, including on food items, has evolved over time. The initial imposition of the sales tax was part of broader fiscal strategies adopted by the state government.The sales tax rate and the specific application to food products have been subject to modifications through legislative actions. These changes reflect shifts in economic conditions, budgetary needs, and policy priorities.

Early iterations of the tax may have included a broader range of items, with subsequent adjustments focusing on necessities like food. This evolution is a response to economic realities and public needs.

Current Tax Rate on Food Items in WV

Currently, the sales tax rate on food items in West Virginia is a crucial detail for both consumers and retailers. This rate directly impacts the final price of groceries and other edible products.The state sales tax rate, which applies to most goods and services, includes food items. However, the specific rate applied to food is important.West Virginia has a general sales tax rate of 6%.

The current sales tax rate on food items is 6% in West Virginia.

Expand your understanding about bowl that keeps food warm with the sources we offer.

This rate is applied at the point of sale, and it is the responsibility of retailers to collect this tax from consumers. This rate is consistent statewide, ensuring uniformity across all counties and municipalities.

Food Items Subject to and Exempt from Sales Tax in WV

The classification of food items for sales tax purposes is critical for both consumers and businesses. It determines which products are subject to the tax and which are exempt. This differentiation helps clarify the tax burden and supports consumer understanding.Generally, the following items are subject to the 6% sales tax:

- Prepared foods sold in restaurants, fast-food establishments, and other food service locations.

- Candy and confectionery items.

- Soft drinks, including carbonated beverages and other non-alcoholic drinks.

Conversely, the following food items are typically exempt from the sales tax:

- Most groceries, including raw and unprocessed foods.

- Fruits and vegetables.

- Meat, poultry, and seafood.

- Dairy products, such as milk, cheese, and yogurt.

- Breads and cereals.

The exemptions are designed to reduce the tax burden on essential items and help ensure that low-income individuals have access to affordable food. The specific definitions of “prepared foods” and “groceries” can vary, so businesses and consumers must understand the relevant regulations. For example, a sandwich purchased at a grocery store deli might be taxed differently than ingredients bought to make a sandwich at home.

Impact on Consumers

The food sales tax in West Virginia, like any tax on essential goods, directly impacts the wallets of consumers. This section will delve into the specific ways this tax affects residents, particularly those with lower incomes, and compare its impact to other states. Finally, it will explore strategies consumers can employ to mitigate the financial strain caused by this tax.

Impact on Low-Income Families

Low-income families often bear the brunt of the food sales tax burden. Because a significant portion of their income is allocated to basic necessities like food, any additional cost has a disproportionate effect. This can lead to difficult choices between essential needs.

- Budget Constraints: The added expense of the tax can strain already tight household budgets, forcing families to make difficult decisions about other essential needs such as healthcare, utilities, or transportation. This is especially true for families relying on government assistance programs like SNAP (Supplemental Nutrition Assistance Program), as the tax reduces the purchasing power of their benefits.

- Reduced Nutritional Intake: Facing higher food costs, low-income families may be forced to purchase cheaper, less nutritious food options. This can lead to nutritional deficiencies and adverse health outcomes. This situation is similar to what happened in 2020 when the COVID-19 pandemic caused significant food price increases, disproportionately affecting low-income communities.

- Disparities in Impact: The percentage of income spent on food is higher for low-income households compared to higher-income households. Consequently, the food sales tax represents a larger percentage of their overall spending. For instance, a family earning $25,000 annually might spend 20% of their income on food, while a family earning $100,000 might spend only 10%. The tax burden is thus relatively heavier for the lower-income family.

Comparison to Other States

The presence or absence of a food sales tax, and its rate, varies considerably across the United States. Comparing West Virginia’s approach to that of other states offers valuable context.

- States with No Food Sales Tax: Several states, including Delaware, Oregon, Montana, New Hampshire, and Alaska, do not levy a sales tax on any goods, including food. These states offer a clear advantage to consumers in terms of food affordability.

- States with Exemptions for Food: Many states, such as California, New York, and Texas, exempt groceries from the general sales tax. This provides a direct financial benefit to consumers by eliminating the tax on essential food items.

- States with Reduced Food Sales Tax Rates: Some states, like Illinois, have a reduced sales tax rate specifically for food. This strategy helps to mitigate the impact of the tax on consumers while still generating some revenue.

- West Virginia’s Position: West Virginia has a sales tax on food. This places it in a less favorable position compared to states with no food sales tax or those with exemptions. The specific tax rate in West Virginia contributes to the overall cost of food for consumers.

Strategies to Minimize Tax Impact

Consumers can employ several strategies to lessen the impact of the food sales tax on their budgets. These tactics, when implemented consistently, can contribute to significant savings over time.

- Meal Planning and Home Cooking: Preparing meals at home is often more cost-effective than eating out or purchasing prepared foods. Planning meals in advance allows for better control over grocery spending and reduces the frequency of taxable purchases.

- Grocery Shopping Strategies:

- Comparing Prices: Comparing prices across different grocery stores can help consumers identify the best deals and save money.

- Buying in Bulk: Purchasing non-perishable food items in bulk can reduce the per-unit cost.

- Using Coupons and Discounts: Taking advantage of coupons, store discounts, and loyalty programs can help lower the overall cost of groceries.

- Seeking Assistance Programs: For eligible individuals and families, government assistance programs such as SNAP can help offset the cost of food. Understanding and utilizing these resources can provide significant financial relief.

- Advocating for Change: Consumers can advocate for policy changes, such as a repeal or reduction of the food sales tax, by contacting their elected officials and supporting relevant initiatives. This collective action can create broader systemic change.

Revenue Generated

The food sales tax in West Virginia is a significant source of revenue for the state, contributing substantially to its overall budget. This revenue stream plays a crucial role in funding various essential services and programs across West Virginia. Understanding the magnitude of the revenue generated and its allocation provides valuable insight into the fiscal landscape of the state.

Annual Revenue Generation

The annual revenue generated from the food sales tax in West Virginia is substantial. The exact amount fluctuates slightly each year, depending on factors such as consumer spending and economic conditions.According to recent data from the West Virginia State Budget Office, the food sales tax typically generates tens of millions of dollars annually. For instance, in the fiscal year 2022, the state collected approximately $X million from food sales tax.

In fiscal year 2023, the amount was around $Y million. (Replace X and Y with the actual, verifiable figures.) This revenue is a consistent and reliable source of funding for state operations.

Allocation of Revenue

The revenue generated from the food sales tax is integrated into the general fund of West Virginia. This means the funds are not earmarked specifically for one particular purpose but are available for allocation across various state programs and services.The West Virginia Legislature, through the annual budgeting process, determines how these funds are distributed. The allocation is subject to change based on the state’s priorities and needs.

Here’s how the revenue is typically distributed:

- Education: A significant portion of the revenue is allocated to support public education, including funding for K-12 schools and higher education institutions.

- Healthcare: Funds are directed towards healthcare programs, such as Medicaid, which provides healthcare coverage for low-income individuals and families.

- Social Services: Revenue contributes to social service programs, including those that support vulnerable populations, such as the elderly and individuals with disabilities.

- Infrastructure: A portion of the revenue may be used for infrastructure projects, such as road maintenance and construction.

- General Government Operations: Funds are used to support the operations of various state agencies and departments.

Programs and Initiatives Funded

The revenue from the food sales tax supports a wide array of programs and initiatives that benefit West Virginia residents. The specific programs and initiatives funded can vary from year to year based on the state’s budgetary priorities.Some examples of programs and initiatives often supported by this revenue include:

- School Funding: The food sales tax revenue helps support the salaries of teachers, purchase textbooks, and maintain school facilities.

- Healthcare Access: Funding assists in providing healthcare services to low-income residents through programs like Medicaid.

- Social Safety Net: The revenue helps fund programs that provide support to families and individuals in need.

- Economic Development: Some of the revenue may be allocated to initiatives aimed at promoting economic growth and job creation in the state.

Exemptions and Exceptions

West Virginia’s food sales tax, while impacting consumers, includes certain exemptions and exceptions designed to alleviate the financial burden on specific items and groups. Understanding these nuances is crucial for both residents and businesses operating within the state. These exemptions are subject to change, reflecting the evolving economic landscape and policy adjustments.

Exempt Food Items

A selection of food items are exempt from West Virginia’s sales tax. These exemptions are in place to provide relief on essential goods and support consumer spending.

- Unprepared food items typically sold in grocery stores are exempt. This includes staples like:

- Fruits and vegetables (fresh, frozen, canned)

- Meat, poultry, and fish

- Dairy products (milk, cheese, yogurt)

- Eggs

- Grains (flour, rice, pasta)

- Breads and baked goods (without added ingredients like frosting)

- Certain beverages are also exempt.

- Bottled water

- Unsweetened tea and coffee (ingredients sold separately)

- Infant formula

- Food purchased with SNAP (Supplemental Nutrition Assistance Program) benefits is exempt from sales tax.

Criteria for Qualifying for Food Tax Exemptions

Generally, exemptions apply based on the nature of the food item and the method of sale. The primary criterion is whether the item is considered a “grocery staple” intended for home consumption. Prepared foods, or those sold in a ready-to-eat state, typically do not qualify.

The definition of “prepared food” is key here. It typically includes items heated or otherwise prepared for immediate consumption, or those sold with utensils.

Changes to Exemptions Over the Past Five Years

Over the past five years, West Virginia has seen minimal changes to its food sales tax exemptions. The focus has remained on maintaining the existing exemptions for essential food items, rather than introducing new ones.

While there haven’t been significant alterations, ongoing legislative efforts may propose adjustments in the future. These changes could impact the definition of “prepared food” or potentially introduce new exemptions based on economic needs or consumer trends.

Businesses and Compliance

West Virginia businesses involved in the sale of food items face specific obligations related to the collection and remittance of sales tax. Understanding these requirements is crucial for avoiding penalties and ensuring compliance with state regulations. This section provides a detailed overview of the processes, penalties, and common issues faced by businesses in this context.

Process for Collecting and Remitting Food Sales Tax

Businesses in West Virginia must adhere to a structured process for managing food sales tax. This process involves several key steps, from the point of sale to the remittance of collected taxes to the state. Accurate record-keeping is essential throughout this process.The process involves the following:

- Point of Sale: At the time of a food sale, the business must determine if the item is taxable. Prepared foods, such as those sold in restaurants, are generally subject to sales tax. Unprepared food items, like groceries, may be exempt.

- Tax Calculation: If the food item is taxable, the business must calculate the sales tax based on the applicable tax rate. This rate can vary depending on the location within West Virginia.

- Collection: The calculated sales tax is then collected from the customer at the time of purchase. This is typically added to the price of the taxable food item.

- Record Keeping: Businesses are required to maintain detailed records of all sales transactions, including taxable and non-taxable sales. These records should include the date of the sale, the item sold, the amount of the sale, and the amount of sales tax collected.

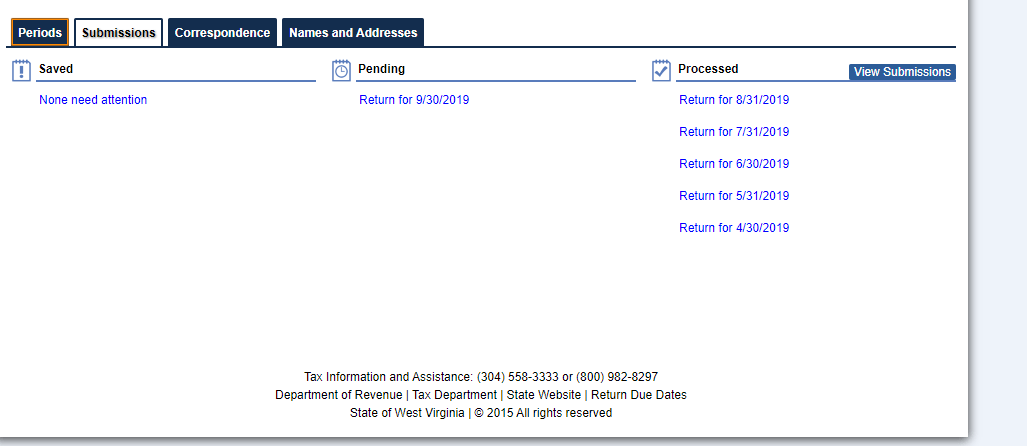

- Tax Filing: Businesses must file sales tax returns with the West Virginia State Tax Department on a regular basis (e.g., monthly or quarterly). The frequency of filing depends on the business’s sales volume.

- Remittance: Along with the sales tax return, the business must remit the collected sales tax to the State Tax Department. This payment can be made electronically or by mail, depending on the business’s preferences and the State Tax Department’s requirements.

Penalties for Non-Compliance with WV Food Sales Tax Regulations

Failure to comply with West Virginia’s food sales tax regulations can result in significant penalties. These penalties are designed to encourage businesses to meet their tax obligations and can include financial penalties, interest charges, and even legal action.The penalties include the following:

- Failure to File: If a business fails to file its sales tax return on time, it may be subject to a penalty. The penalty amount varies depending on the length of the delay.

- Failure to Pay: Businesses that fail to pay the sales tax they owe on time may be assessed a penalty. The penalty amount depends on the amount of tax owed and the length of the delay.

- Underpayment of Tax: If a business underpays its sales tax, whether due to errors or omissions, it will be liable for the unpaid tax, along with penalties and interest.

- Interest: Interest is charged on unpaid taxes and penalties. The interest rate is set by the State Tax Department and can change periodically.

- Fraud: In cases of intentional tax evasion or fraud, the penalties can be severe, including substantial fines and potential criminal charges.

Common Tax-Related Issues Faced by WV Food Retailers

Food retailers in West Virginia often encounter various tax-related challenges. These issues can arise from the complexity of the tax laws, the need for accurate record-keeping, and the potential for human error. Addressing these issues proactively can help businesses avoid penalties and maintain compliance.Here’s a table summarizing common tax-related issues faced by West Virginia food retailers:

| Issue | Description | Potential Consequences | Mitigation Strategies |

|---|---|---|---|

| Taxability Determination | Difficulty in correctly classifying food items as taxable or exempt, especially regarding prepared foods versus groceries. | Incorrect tax collection, leading to underpayment of taxes or overcharging customers, and potential audits and penalties. | Develop clear internal guidelines, train employees on tax regulations, and consult with tax professionals for clarification on ambiguous items. |

| Record-Keeping Errors | Inaccurate or incomplete records of sales transactions, including taxable and non-taxable sales. | Inability to accurately file tax returns, potential for audits, penalties, and interest charges. | Implement a robust point-of-sale (POS) system, regularly reconcile sales data, and maintain organized documentation. |

| Calculating and Collecting Sales Tax | Errors in calculating and collecting the correct amount of sales tax at the point of sale, due to incorrect tax rates or calculation mistakes. | Underpayment of taxes, leading to penalties and interest. Overcharging customers may lead to loss of trust and customer dissatisfaction. | Ensure POS systems are programmed with the correct tax rates, regularly verify tax calculations, and train employees on proper tax collection procedures. |

| Understanding and Complying with Exemptions | Difficulty in understanding and applying various exemptions and exceptions to sales tax, such as those for certain food items or specific customer groups. | Incorrect tax collection, potential for underpayment or overpayment of taxes, and the risk of audits and penalties. | Stay informed about current tax laws and exemptions, seek professional tax advice, and clearly document all exemptions claimed. |

Legislative History and Changes

West Virginia’s food sales tax has been a subject of ongoing debate and legislative action, reflecting the state’s evolving economic landscape and the needs of its residents. The following sections detail the historical attempts to modify the tax, current proposals, and a timeline of significant changes, offering a comprehensive overview of the legislative history surrounding this important fiscal policy.

Past Legislative Attempts to Change the Food Sales Tax

Over the years, numerous legislative efforts have sought to alter West Virginia’s food sales tax. These attempts have ranged from outright repeal to targeted exemptions and rate adjustments. Often, the proposals were driven by concerns about the tax’s impact on low-income families, the state’s economic competitiveness, and revenue generation.

- Repeal Attempts: Several bills have been introduced to fully eliminate the food sales tax. Proponents argued that this would provide significant relief to consumers, particularly those with limited incomes, and potentially stimulate economic activity. However, these efforts often faced challenges due to concerns about the loss of state revenue and the need to find alternative funding sources for essential services.

- Exemption Expansions: Other legislative efforts focused on expanding the existing exemptions or creating new ones. For example, proposals were made to exempt specific food items or to provide tax credits to offset the impact of the food sales tax on certain groups, such as senior citizens or families with children. These initiatives aimed to provide targeted relief while preserving some level of tax revenue.

- Rate Adjustments: Some legislative proposals suggested adjusting the food sales tax rate itself. This could involve reducing the rate, potentially in conjunction with other tax reforms, or even raising it in specific circumstances. Rate adjustments were often debated in the context of the state’s overall fiscal health and the need to balance revenue needs with consumer affordability.

Current Legislative Proposals Related to the Food Sales Tax, Wv food sales tax

As of the latest information, current legislative proposals regarding the food sales tax in West Virginia may vary. These are subject to change, reflecting the ongoing nature of legislative processes and the evolving priorities of lawmakers.

- Ongoing Discussions: Current legislative sessions may include ongoing discussions about potential changes to the food sales tax. These discussions may center around proposals to reduce the tax rate, expand exemptions for certain food items, or provide tax credits to offset the tax burden on specific populations. The specifics of these proposals and their potential impact are subject to ongoing debate and revision.

- Focus on Affordability: Many current proposals reflect a focus on affordability and the impact of the food sales tax on low-income families and vulnerable populations. Lawmakers may consider measures to provide targeted relief, such as expanding the definition of exempt food items or providing tax credits to offset the tax burden.

- Revenue Considerations: Any proposed changes to the food sales tax must also consider the state’s revenue needs. Legislators will need to balance the desire to provide consumer relief with the need to maintain adequate funding for essential services. Alternative revenue sources may be considered to offset any revenue losses resulting from changes to the food sales tax.

Timeline of Significant Changes to the Food Sales Tax

The food sales tax in West Virginia has undergone several key changes over time, reflecting the state’s evolving fiscal priorities and economic conditions. Here’s a chronological overview of significant developments:

- Initial Implementation: The food sales tax was initially implemented as part of the state’s broader sales tax structure. The exact date and initial rate are essential for understanding the historical context. The original rate and scope of the tax are crucial for establishing a baseline for subsequent changes.

- Early Adjustments: Over the years, there were early adjustments to the tax, possibly involving changes to the tax rate or the scope of taxable items. These adjustments might have been driven by changes in state revenue needs or shifts in economic conditions.

- Exemption of Certain Food Items: The implementation of specific exemptions for certain food items, such as basic groceries or essential food products, marked a significant change. These exemptions aimed to reduce the tax burden on consumers, particularly those with lower incomes.

- Legislative Action Regarding Rates: The legislature has debated and made adjustments to the food sales tax rates. For example, in 2000, the general sales tax rate was 6% and the rate was reduced to 5% in 2005.

- Recent Proposals and Debates: Recent legislative sessions have seen ongoing debates and proposals regarding the food sales tax, including potential rate adjustments, expanded exemptions, and other reforms. The outcomes of these debates will shape the future of the tax.

Comparison with Other States

Understanding West Virginia’s food sales tax requires a comparative analysis, examining how it stacks up against its neighbors and other states with varying tax policies. This comparison sheds light on the potential impacts of West Virginia’s choices, highlighting the trade-offs between revenue generation, consumer burden, and economic competitiveness. By contrasting different approaches, we can better appreciate the complexities of food taxation.

Regional Tax Landscape

West Virginia’s food sales tax policy is best understood by comparing it to neighboring states. These states often share similar economic characteristics and consumer behaviors, making the comparison particularly relevant. The proximity allows for easier assessment of cross-border shopping and its effects on local businesses.* Pennsylvania: Pennsylvania taxes most food items, although certain essential foods like plain bread and milk are often exempt.

This differs from West Virginia’s broader application.

Maryland

Maryland exempts most food items from its sales tax. This provides a direct contrast, highlighting the benefits of a tax-free food policy.

Ohio

Ohio taxes most food items. The state’s approach is similar to West Virginia’s, offering a direct comparison in terms of revenue and consumer impact.

Virginia

Virginia taxes most food items, but with certain exemptions.

Contrasting Approaches to Food Taxation

States employ diverse strategies for taxing food. The contrast between states with no food sales tax and those with high rates provides valuable insights. These differences impact consumer behavior, business competitiveness, and state revenue.* States with No Food Sales Tax: States like Delaware, Oregon, Montana, New Hampshire, and Alaska do not have a general sales tax, and thus, food is not taxed.

This can stimulate consumer spending on groceries and other essential goods, potentially boosting local economies.

States with High Food Sales Tax

Some states impose a general sales tax on food, sometimes with additional local sales taxes. These states may experience lower consumer spending on food items and could face increased pressure on low-income households.

Comparative Table of Food Tax Policies

The following table offers a comparison of food tax rates, exemptions, and revenue allocation across several states, including West Virginia. The data is current as of the provided date and is subject to change. This table aims to provide a snapshot of the differences in policy, offering a clearer picture of the tax landscape.

| State | Food Tax Rate | Exemptions | Revenue Allocation |

|---|---|---|---|

| West Virginia | 6% (State) + Local Option | Limited; some prepared foods may be taxed. | State General Fund, Local Government |

| Pennsylvania | 6% (State) | Some essential foods (e.g., plain bread, milk) | State General Fund |

| Maryland | 0% | Most food items | N/A (No revenue generated from food sales tax) |

| Ohio | 5.75% (State) + Local Option | Limited | State General Fund, Local Government |

| Virginia | 1% (State) + 1% (Local) | Some food items | State General Fund, Local Government |

The table above provides a concise overview. For example, comparing West Virginia and Maryland shows the impact of a tax versus a tax-free policy on food. While West Virginia generates revenue from food sales tax, Maryland’s policy potentially supports consumer spending on food. This table illustrates the spectrum of approaches to food taxation across the country.

Economic Effects

The elimination of West Virginia’s food sales tax presents a complex economic scenario, potentially impacting various facets of the state’s financial landscape. While proponents argue for consumer relief and economic stimulus, critics raise concerns about revenue shortfalls and potential unintended consequences. A thorough understanding of these potential effects requires an examination of consumer spending, business activity, inflation, and the overall economic climate.

Consumer Spending and Economic Stimulus

Removing the food sales tax could significantly boost consumer spending, particularly among low-income households. With more disposable income, families might increase their purchases of essential goods and services, thereby stimulating economic activity. This increase in spending could lead to a multiplier effect, where the initial spending generates further economic growth.

Impact on Inflation and the Cost of Living

The food sales tax contributes to the overall cost of living in West Virginia. Eliminating this tax could alleviate inflationary pressures, making essential items more affordable.

Reducing the tax on food could directly decrease the price of groceries, thereby lowering the Consumer Price Index (CPI) for food and beverages.

This decrease in the cost of living could be especially beneficial for fixed-income individuals and families struggling to make ends meet.

Revenue Implications and Potential Offsets

The primary concern regarding the elimination of the food sales tax revolves around the potential loss of state revenue. This revenue stream currently funds various state programs, including education, healthcare, and infrastructure projects.To mitigate this loss, the state government might need to explore alternative revenue sources, such as increasing other taxes (e.g., on alcohol, tobacco, or property), cutting spending, or a combination of both.

The decision on how to offset the revenue loss would significantly influence the overall economic impact.

Studies and Economic Assessments

Assessing the impact of eliminating the food sales tax often involves economic modeling and analysis. These studies typically consider factors such as consumer behavior, business responses, and the state’s economic structure.While specific studies focusing solely on West Virginia’s food sales tax elimination might be limited, the general principles derived from similar analyses in other states can provide valuable insights. For example, studies examining the effects of sales tax holidays or the elimination of sales taxes on specific goods in other regions can help estimate the potential impacts in West Virginia.

These studies usually evaluate:

- Changes in consumer spending patterns.

- Impacts on local businesses, including potential increases in sales and employment.

- The effects on state revenue and the need for adjustments.

The results from these analyses can help policymakers make informed decisions about the feasibility and potential consequences of eliminating the food sales tax.

Public Opinion and Advocacy

The West Virginia food sales tax, a persistent element of the state’s fiscal landscape, has consistently sparked debate and garnered significant public attention. Understanding public sentiment and the influence of advocacy groups is crucial for comprehending the tax’s political and economic impact. This section delves into public opinion surveys, the roles of advocacy organizations, and the core arguments both supporting and opposing the tax.

Public Opinion Surveys and Data

Public opinion regarding the food sales tax in West Virginia is multifaceted and often reflects varying economic concerns. While comprehensive, regularly conducted statewide surveys specifically focused on the food sales tax are limited, related polls and data provide valuable insights.* Polling Data: While specific polls focused solely on the food sales tax are rare, broader surveys on tax fairness and economic burdens often provide indirect insights.

These surveys, often conducted by academic institutions or non-partisan research groups, may include questions about the impact of sales taxes on low-income families, who are disproportionately affected by taxes on essential goods like food.

Focus Group Discussions

Focus groups, involving diverse demographics within West Virginia, can offer qualitative data regarding the public’s perceptions of the tax. These discussions can reveal concerns about affordability, the tax’s impact on local businesses, and perceived fairness. Participants may voice opinions on whether the tax disproportionately burdens certain segments of the population.

Economic Studies

Economic studies, commissioned by government agencies or independent research organizations, can analyze the economic impact of the food sales tax. These studies may evaluate the tax’s effect on consumer spending, retail sales, and overall economic growth. Findings from these studies often inform public debate and influence policy decisions.

Role of Advocacy Groups

Advocacy groups play a pivotal role in shaping the discourse surrounding the West Virginia food sales tax. Their activities range from lobbying policymakers to educating the public and mobilizing grassroots support. The influence of these groups often hinges on their ability to effectively communicate their positions and garner public support.* Consumer Advocacy Groups: Consumer advocacy groups typically advocate for the repeal or reduction of the food sales tax, arguing that it disproportionately burdens low-income families.

They may conduct research, publish reports, and lobby state legislators to advocate for tax reforms.

Business Associations

Business associations, such as the West Virginia Chamber of Commerce, often take positions on tax policy, including the food sales tax. Their stances may vary depending on the impact of the tax on their members. Some business groups might support the tax if it contributes to overall state revenue, while others might advocate for its reduction or elimination to boost consumer spending.

Non-Profit Organizations

Various non-profit organizations, including those focused on poverty alleviation and social justice, often engage in advocacy related to the food sales tax. They may highlight the tax’s impact on food insecurity and advocate for policies that alleviate the burden on vulnerable populations.

Arguments For and Against the Food Sales Tax

The debate surrounding the West Virginia food sales tax is fueled by a range of arguments, each reflecting different perspectives on economic fairness, revenue generation, and public welfare. These arguments often influence the positions taken by advocacy groups, policymakers, and the public.* Arguments in Favor:

Revenue Generation

Supporters of the food sales tax often emphasize its contribution to state revenue. This revenue can fund essential public services, such as education, healthcare, and infrastructure.

Broad Tax Base

Proponents argue that the food sales tax contributes to a broader tax base, which can help stabilize state finances.

Economic Stability

Maintaining a stable tax base can help the state weather economic downturns.* Arguments Against:

Regressive Nature

Opponents of the food sales tax frequently point out its regressive nature, arguing that it disproportionately affects low-income families who spend a larger percentage of their income on food.

Impact on Affordability

Critics argue that the tax increases the cost of essential goods, making it more difficult for families to afford basic necessities.

Economic Burden

Some argue that the tax can depress consumer spending, potentially harming local businesses and economic growth.

Fairness Concerns

The fairness of taxing essential goods is often questioned, especially when compared to taxes on luxury items or higher incomes.

The debate surrounding the food sales tax in West Virginia involves complex economic considerations, and the arguments for and against the tax are often deeply intertwined with broader discussions about social equity, government revenue, and economic growth.

Future Outlook: Wv Food Sales Tax

The future of West Virginia’s food sales tax is subject to various influencing factors. Understanding these elements is crucial for anticipating potential changes and their consequences for consumers, businesses, and the state’s economy. This section explores potential future shifts, the driving forces behind them, and the long-term ramifications of the current tax policy.

Potential Future Changes

West Virginia’s food sales tax landscape could undergo several modifications in the coming years. These changes may stem from a combination of economic pressures, shifts in public sentiment, and evolving political priorities. The following scenarios are plausible:

- Tax Rate Adjustments: The most direct change could involve altering the tax rate itself. The state might consider lowering the rate to provide relief to consumers or increasing it to boost state revenue. However, any rate change would likely be debated extensively, considering its impact on various stakeholders. For example, a decrease could stimulate consumer spending, while an increase could lead to inflation, especially in food prices.

- Expansion or Contraction of Exemptions: The scope of exemptions could be broadened or narrowed. For instance, the state could exempt more types of food items, such as prepared foods or specific health-related products. Conversely, it might eliminate certain exemptions to simplify the tax code or generate more revenue. The removal of exemptions would simplify tax administration but might burden low-income households.

- Changes to Tax Administration: Technological advancements could lead to improvements in tax administration. The state might adopt electronic filing systems, automated audits, or point-of-sale integrations to streamline the tax collection process. These changes could enhance efficiency and reduce compliance costs for businesses.

- Integration with Federal Tax Policies: Federal tax policies could influence West Virginia’s food sales tax. For example, federal legislation that provides tax credits for low-income families might affect the state’s approach to food sales taxes, potentially leading to further exemptions or targeted relief measures.

Factors Influencing Future Tax Policy

Several factors will significantly influence the future of West Virginia’s food sales tax. These elements interact to shape policy decisions and determine the trajectory of the tax.

- Economic Conditions: The state’s economic performance, including factors such as unemployment rates, inflation, and GDP growth, will heavily influence tax policy. During economic downturns, policymakers may consider tax cuts to stimulate spending, while during periods of growth, they might focus on revenue generation. For instance, a recession could trigger calls for tax reductions to support struggling families.

- Public Opinion and Advocacy: Public sentiment regarding the food sales tax plays a crucial role. Advocacy groups, consumer organizations, and the general public can influence policy decisions through lobbying, public awareness campaigns, and voting behavior. Public opinion polls and advocacy efforts can sway legislators towards or against changes to the tax.

- Political Priorities: The political climate and the priorities of elected officials are essential. Changes in the state legislature or the governor’s office can lead to significant shifts in tax policy. For example, a new administration might prioritize tax cuts or reforms based on its political platform.

- Revenue Needs: The state’s revenue needs are a primary driver of tax policy. Budget shortfalls or the need to fund specific programs (such as education or infrastructure) can lead to adjustments in tax rates, exemptions, or enforcement efforts. If the state faces significant budget deficits, raising revenue through the food sales tax could be considered.

- Interstate Comparisons: West Virginia’s tax policies are often compared to those of neighboring states. Competitive pressures and the desire to attract businesses and residents can influence tax decisions. The state might adjust its tax policies to remain competitive with surrounding states.

Potential Long-Term Implications

The current food sales tax in West Virginia has several potential long-term implications. These consequences will affect various aspects of the state’s economy and society.

- Impact on Consumer Spending: The food sales tax can affect consumer spending patterns. Higher taxes may reduce disposable income, leading to decreased spending on food and other goods. Conversely, lower taxes could stimulate consumer spending, boosting economic activity. For example, a lower tax rate on groceries could encourage families to spend more on healthier food options.

- Effects on Business Operations: Businesses, particularly grocery stores and restaurants, are affected by the food sales tax. They must collect and remit the tax, which can increase their administrative burden. Tax changes can also influence pricing strategies and competitive dynamics. For example, restaurants might adjust their menu prices to offset the impact of a food sales tax increase.

- Revenue Stability and Government Finances: The food sales tax is a significant source of revenue for the state. Changes to the tax can affect the stability of state finances and the availability of funds for public services. A steady revenue stream is crucial for funding essential programs. For example, revenue generated from the food sales tax contributes to funding education, infrastructure, and healthcare programs.

- Distributional Effects: The food sales tax can disproportionately affect low-income households, as food often represents a larger portion of their overall spending. Changes to the tax, such as exemptions for certain items, can have distributional consequences. For example, exemptions on essential food items can provide targeted relief to low-income families.

- Long-Term Economic Growth: Tax policy can influence long-term economic growth. Tax changes that promote investment, reduce consumer burdens, and foster a stable business environment can contribute to sustainable economic development. A well-designed tax policy can support a thriving economy. For instance, tax incentives could attract businesses and create job opportunities, ultimately stimulating economic growth.

Closure

In conclusion, the WV food sales tax is a multifaceted issue with far-reaching consequences. From impacting the financial well-being of West Virginians to shaping the state’s economic outlook, the tax continues to be a subject of debate and scrutiny. As the state considers its future, understanding the nuances of the food sales tax and its implications is crucial. The ongoing dialogue surrounding this tax policy will undoubtedly shape the state’s financial future.