Welcome, everyone, to the dynamic world of Flower Foods Investor Relations! Today, we’re not just talking about bread and baked goods; we’re diving deep into the strategies that fuel a publicly traded company’s success. Imagine a company built on generations of baking expertise, now navigating the complexities of the modern financial landscape. This is the story of Flower Foods, a testament to resilience, adaptation, and the power of clear communication.

We’ll explore how Flower Foods connects with its investors, builds trust, and paints a compelling picture of its future.

We’ll uncover the core of Flower Foods’ business, its historical milestones, and the critical role investor relations plays in its sustained success. We’ll dissect communication channels, financial reporting processes, and the all-important investor relations calendar. Prepare to gain insights into key financial metrics, examine illustrative financial statements, and learn how Flower Foods presents its story during earnings calls. This isn’t just about numbers; it’s about understanding the strategic dance between a company and its investors.

Overview of Flower Foods and Investor Relations

Flower Foods, a prominent player in the packaged bakery industry, operates with a focus on brand recognition and distribution efficiency. Its success hinges on its ability to manage a diverse portfolio of well-known brands and maintain a robust supply chain to ensure product availability across a wide geographic area. The company’s approach to investor relations is critical for maintaining shareholder value and navigating the complexities of the public market.

Core Business and Industry Position

Flower Foods’ core business centers around the production and distribution of packaged bakery foods. The company’s product portfolio includes a range of items such as bread, buns, rolls, snack cakes, and tortillas, catering to a broad consumer base. Its market position is characterized by its ownership of significant brands and its extensive direct-store-delivery (DSD) network.Flower Foods’ position within the food industry is substantial, given the size and scope of its operations.

The company competes in a highly competitive landscape, contending with both national and regional players, as well as private-label brands. Its ability to differentiate itself through brand recognition, product quality, and efficient distribution is crucial for maintaining its market share. The packaged bakery industry is generally considered to be relatively stable, with consistent demand for its products, which provides a foundation for long-term growth, though it is also subject to shifts in consumer preferences and raw material costs.

History and Key Milestones

Flower Foods has a rich history marked by strategic acquisitions and organic growth. The company’s origins trace back to 1919 with the establishment of the Flowers Baking Company in Thomasville, Georgia. Over the decades, Flower Foods expanded through a series of acquisitions, transforming itself from a regional bakery into a national powerhouse.Key milestones in Flower Foods’ history include:

- Early Expansion: The company’s initial growth focused on expanding its production capacity and geographic reach within the southeastern United States.

- Acquisition of Brands: The acquisition of major brands like Nature’s Own, Wonder Bread, and Tastykake significantly broadened Flower Foods’ product portfolio and national presence. For instance, the acquisition of Wonder Bread in 2012 provided a substantial boost to its market share and brand recognition.

- Expansion of Distribution: Flower Foods has invested heavily in its DSD network, which has improved its ability to reach consumers and maintain product freshness. This network is a key competitive advantage, providing direct access to retail outlets and control over the supply chain.

- Strategic Focus: Flower Foods has consistently emphasized its core bakery business, focusing on innovation and efficiency to adapt to changing consumer preferences and market conditions.

Significance of Investor Relations

Investor relations play a vital role for Flower Foods, as a publicly traded food company. Effective investor relations are crucial for several reasons:

- Building and Maintaining Investor Confidence: A well-managed investor relations program helps to build trust with investors, providing them with transparent and timely information about the company’s performance, strategy, and future prospects. This is essential for attracting and retaining investors.

- Financial Performance Communication: Investor relations is the primary channel for communicating financial results, including quarterly earnings reports, annual reports, and presentations.

- Shareholder Value Management: By effectively communicating the company’s value proposition and strategy, investor relations helps to support the stock price and enhance shareholder value. This includes addressing investor concerns, responding to inquiries, and providing updates on key developments.

- Stakeholder Engagement: Investor relations facilitates engagement with a broad range of stakeholders, including institutional investors, individual shareholders, and financial analysts. This engagement helps to build relationships and gather valuable feedback.

- Transparency and Disclosure: Flower Foods must comply with regulations, such as those from the Securities and Exchange Commission (SEC), regarding financial reporting and disclosure. Investor relations helps ensure the company meets these requirements and maintains transparency with its investors.

The success of investor relations can be measured by several metrics, including stock price performance, analyst ratings, and investor sentiment.

Investor Relations Strategies at Flower Foods

Flower Foods, as a publicly traded company, employs a multifaceted approach to investor relations, crucial for maintaining shareholder confidence, attracting investment, and ensuring compliance with regulatory requirements. This strategy encompasses various communication channels, a structured process for financial reporting, and a carefully planned calendar of events designed to keep investors informed and engaged. The effectiveness of these strategies is critical to the company’s valuation and overall financial health.

Communication Channels

Flower Foods utilizes a variety of communication channels to disseminate information to investors and stakeholders. These channels are strategically chosen to reach a broad audience and ensure transparency.

- Corporate Website: The company’s investor relations section on its website serves as a central hub for information. It provides access to financial reports, SEC filings (such as 10-K and 10-Q reports), press releases, presentations, and other relevant materials. The website’s design and user-friendliness are essential for easy navigation and information access.

- Press Releases: Flower Foods regularly issues press releases to announce significant company developments, including financial results, acquisitions, divestitures, product launches, and executive appointments. These releases are distributed through established newswires and are often picked up by financial news outlets, ensuring broad dissemination.

- Earnings Calls: Quarterly earnings calls are a critical component of Flower Foods’ investor relations strategy. During these calls, company executives discuss financial performance, provide insights into business operations, and answer questions from analysts and investors. These calls are typically webcast live and are followed by a transcript and audio replay available on the investor relations website.

- Annual Reports: The annual report is a comprehensive document that provides a detailed overview of the company’s performance, strategy, and outlook for the future. It includes financial statements, management’s discussion and analysis (MD&A), and other information crucial for investors. The annual report is often designed with an emphasis on visual appeal and narrative storytelling to engage shareholders.

- Investor Conferences and Presentations: Flower Foods’ management team frequently participates in industry conferences and investor presentations to meet with investors, analysts, and other stakeholders. These events provide an opportunity to share the company’s story, answer questions, and build relationships.

- Email and Direct Communication: Flower Foods may use email or other direct communication channels to distribute important updates or respond to specific inquiries from investors.

Financial Report Preparation and Dissemination Process

The process of preparing and disseminating financial reports at Flower Foods is a highly structured and regulated process, designed to ensure accuracy, transparency, and compliance with regulations. The following steps are involved:

- Data Collection and Consolidation: Financial data from various business units and subsidiaries is collected and consolidated. This involves gathering information from accounting systems, sales reports, and other relevant sources.

- Financial Statement Preparation: Accountants and financial analysts prepare the financial statements, including the income statement, balance sheet, and statement of cash flows. This involves applying accounting principles and ensuring accuracy.

- Internal Review and Verification: The financial statements are reviewed internally by senior management, the finance department, and sometimes by an internal audit team. This process aims to identify and correct any errors or inconsistencies.

- Audit by Independent Auditors: An independent auditing firm (e.g., a Big Four accounting firm) conducts an audit of the financial statements to provide an opinion on their fairness and accuracy. This audit is crucial for building investor confidence.

- SEC Filing Preparation: The company prepares the necessary filings for the Securities and Exchange Commission (SEC), such as the 10-K (annual report) and 10-Q (quarterly report). These filings must adhere to specific SEC regulations and guidelines.

- Press Release and Earnings Call Preparation: Concurrently, the investor relations team prepares a press release summarizing the financial results and key highlights. They also prepare for the earnings call, including the presentation slides and scripts.

- Dissemination: The press release is distributed through newswires, and the financial reports are filed with the SEC and posted on the company’s website. The earnings call is webcast live, and a transcript and replay are made available.

- Investor Communication and Feedback: The investor relations team monitors investor feedback and responds to inquiries. They may also schedule follow-up meetings or presentations to provide further clarification or address concerns.

Typical Investor Relations Calendar

Flower Foods follows a structured investor relations calendar to manage key events and deadlines throughout the year. This calendar helps ensure consistent communication and provides a roadmap for investor engagement.

| Month | Event | Description | Deadline/Timing |

|---|---|---|---|

| January/February | Q4 Earnings Release and Earnings Call | Release of the fourth quarter and full-year financial results. | Late January/Early February |

| February/March | Annual Report Filing (10-K) | Filing of the company’s annual report with the SEC. | Typically within 60-90 days of year-end |

| April/May | Q1 Earnings Release and Earnings Call | Release of the first quarter financial results. | Late April/Early May |

| May/June | Annual Shareholders Meeting | Meeting with shareholders to review the company’s performance and elect directors. | Typically in May or June |

| July/August | Q2 Earnings Release and Earnings Call | Release of the second quarter financial results. | Late July/Early August |

| September/October | Investor Conferences and Presentations | Participation in industry and investor conferences. | Throughout the year, with peak season in the fall |

| October/November | Q3 Earnings Release and Earnings Call | Release of the third quarter financial results. | Late October/Early November |

| Ongoing | Website Updates and SEC Filings | Continuous updates to the investor relations section of the website and SEC filings as needed. | Ongoing |

Financial Performance and Reporting

Flower Foods’ financial performance and reporting are crucial aspects of its investor relations strategy. Providing clear, concise, and accurate financial information is paramount to building and maintaining investor confidence. This section explores the key financial metrics investors in the food industry consider, illustrates financial statements with a simplified example, and details how Flower Foods communicates its financial performance during earnings calls.

Key Financial Metrics for Investors

Investors in the food industry, like those considering Flower Foods, carefully analyze a variety of financial metrics to assess a company’s performance, financial health, and growth potential. These metrics provide insights into profitability, efficiency, and the ability to generate cash flow.

- Revenue Growth: This is a fundamental metric, measuring the increase in sales over a period. Investors seek consistent and sustainable revenue growth, which indicates a company’s ability to capture market share and meet consumer demand. For instance, consistent organic revenue growth in Flower Foods’ core branded business is a key indicator of success.

- Gross Profit Margin: This represents the percentage of revenue remaining after deducting the cost of goods sold (COGS). A healthy gross profit margin indicates efficient production and pricing strategies. An increasing gross profit margin, or at least maintaining it, is often viewed favorably.

- Operating Profit Margin: This metric reflects profitability after accounting for operating expenses, such as selling, general, and administrative costs. It provides insight into how well a company manages its operating costs.

- Net Profit Margin: This is the percentage of revenue that remains after all expenses, including taxes and interest, are deducted. It’s a critical measure of overall profitability. A higher net profit margin signals a more profitable business.

- Earnings Per Share (EPS): This metric indicates the portion of a company’s profit allocated to each outstanding share of common stock. It is a crucial indicator of profitability and a key factor in determining the company’s stock price. Changes in EPS are closely scrutinized by investors.

- Free Cash Flow (FCF): This represents the cash flow available to a company after accounting for capital expenditures. A positive and growing FCF indicates the company’s ability to generate cash to reinvest in its business, pay dividends, or reduce debt.

- Debt-to-Equity Ratio: This ratio measures the proportion of debt a company uses to finance its assets relative to the value of shareholder equity. A lower ratio generally suggests a healthier financial position and less risk.

- Return on Equity (ROE): This measures how effectively a company uses shareholder investments to generate profit. A higher ROE indicates that the company is efficiently using its equity to generate earnings.

- Return on Assets (ROA): This indicates how effectively a company is using its assets to generate earnings. It shows the profitability of the company relative to its assets.

Simplified Financial Statement Example

To illustrate, here’s a simplified example of an income statement, balance sheet, and cash flow statement, reflecting hypothetical data for Flower Foods. This example is for illustrative purposes only and does not represent actual financial figures.

You also will receive the benefits of visiting red meat dog food today.

| Item | Amount | Year |

|---|---|---|

| Income Statement | ||

| Revenue | $1,000 million | 2023 |

| Cost of Goods Sold (COGS) | $600 million | 2023 |

| Gross Profit | $400 million | 2023 |

| Operating Expenses | $250 million | 2023 |

| Operating Income | $150 million | 2023 |

| Interest Expense | $20 million | 2023 |

| Income Tax Expense | $30 million | 2023 |

| Net Income | $100 million | 2023 |

| Balance Sheet | End of 2023 | |

| Assets | ||

| Cash and Cash Equivalents | $50 million | 2023 |

| Accounts Receivable | $100 million | 2023 |

| Inventory | $150 million | 2023 |

| Property, Plant, and Equipment (PP&E) | $500 million | 2023 |

| Total Assets | $800 million | 2023 |

| Liabilities and Equity | ||

| Accounts Payable | $75 million | 2023 |

| Debt | $225 million | 2023 |

| Total Liabilities | $300 million | 2023 |

| Shareholder’s Equity | $500 million | 2023 |

| Total Liabilities and Equity | $800 million | 2023 |

| Cash Flow Statement | 2023 | |

| Cash Flow from Operations | $120 million | 2023 |

| Cash Flow from Investing | ($30 million) | 2023 |

| Cash Flow from Financing | ($20 million) | 2023 |

| Net Change in Cash | $70 million | 2023 |

Communicating Financial Performance During Earnings Calls

Flower Foods uses earnings calls to communicate its financial performance to investors. These calls are a crucial component of its investor relations strategy, providing an opportunity to discuss the company’s results, address investor questions, and offer insights into future prospects.

- Prepared Statements: The call typically begins with prepared remarks from the CEO and CFO, summarizing the financial results for the quarter or year. These statements highlight key performance indicators (KPIs), such as revenue growth, gross margin, and earnings per share. For example, the CEO might discuss the impact of recent acquisitions on revenue growth, while the CFO might explain the factors affecting the gross margin.

- Financial Review: The CFO provides a detailed review of the financial statements, including revenue, cost of goods sold, operating expenses, and net income. This section often includes comparisons to the previous year and guidance for future periods.

- Operational Highlights: The call often includes a discussion of operational highlights, such as new product launches, market share gains, and supply chain efficiency improvements. This helps investors understand the underlying drivers of financial performance.

- Q&A Session: A question-and-answer session follows the prepared remarks, where analysts and investors can ask questions about the company’s performance, strategy, and outlook. The company’s executives respond to these questions, providing clarification and context. The ability to address questions directly is key to transparency.

- Forward-Looking Statements: Flower Foods, like other publicly traded companies, makes forward-looking statements during earnings calls. These statements involve predictions about future performance and are subject to risks and uncertainties. The company typically includes a disclaimer to protect itself from potential liability. For example, a company might forecast a certain revenue growth rate for the next quarter, but this is subject to market conditions and other variables.

Corporate Governance and Ethics

Flower Foods’ commitment to strong corporate governance and ethical conduct is crucial for maintaining investor confidence, ensuring long-term sustainability, and fostering positive relationships with stakeholders. A robust framework in this area provides a foundation for responsible decision-making, risk management, and transparent operations. This section examines the key aspects of Flower Foods’ approach to corporate governance and ethics, comparing it to industry peers.

Key Members of the Flower Foods Leadership Team and Their Roles

The effectiveness of any company’s governance structure relies heavily on the leadership team. At Flower Foods, the key executives are responsible for setting the strategic direction, overseeing operations, and ensuring accountability.The key members and their roles include:

- Chief Executive Officer (CEO): The CEO is responsible for the overall strategic direction and performance of the company. They lead the executive team and are accountable to the Board of Directors. For example, the CEO sets the vision for growth, makes critical decisions about resource allocation, and represents the company to external stakeholders.

- Chief Financial Officer (CFO): The CFO oversees all financial matters, including financial reporting, budgeting, and investor relations. They ensure the company’s financial health and compliance with financial regulations. The CFO’s responsibilities include managing financial risks and communicating financial performance to the board and investors.

- Chief Operating Officer (COO): The COO is responsible for overseeing the day-to-day operations of the company, including manufacturing, supply chain, and distribution. They ensure operational efficiency and effectiveness. For example, the COO implements operational strategies to meet production targets and optimize logistics.

- Chief Legal Officer (CLO): The CLO is responsible for all legal matters, ensuring the company’s compliance with laws and regulations. They provide legal counsel to the executive team and the board. This role is critical in managing legal risks and ensuring ethical conduct across the organization.

- Board of Directors: The Board of Directors is responsible for overseeing the management of the company and representing the interests of shareholders. They set strategic direction, monitor performance, and ensure accountability of the executive team.

Flower Foods’ Commitment to Corporate Social Responsibility (CSR) and Sustainability

Flower Foods integrates corporate social responsibility (CSR) and sustainability into its business practices. These initiatives reflect a commitment to environmental stewardship, social responsibility, and ethical governance.Flower Foods’ CSR and sustainability initiatives include:

- Environmental Sustainability: This includes reducing greenhouse gas emissions, conserving water, and minimizing waste. For example, Flower Foods has invested in energy-efficient equipment and renewable energy sources at its bakeries.

- Social Responsibility: This focuses on supporting local communities, promoting employee well-being, and ensuring fair labor practices. Flower Foods supports various community initiatives, providing food donations and volunteer opportunities.

- Ethical Governance: This involves maintaining high standards of ethical conduct, transparency, and accountability in all business operations. The company has implemented robust ethics training programs for its employees and maintains a code of conduct.

- Sustainable Sourcing: Flower Foods aims to source ingredients from sustainable and responsible suppliers. This involves working with suppliers who adhere to environmental and social standards.

Comparison of Flower Foods’ Corporate Governance Practices with Competitors

A comparative analysis reveals how Flower Foods’ corporate governance practices stack up against those of its competitors. The table below provides a high-level overview.

| Practice | Flower Foods | Competitor A | Competitor B |

|---|---|---|---|

| Board Composition (Independent Directors) | Majority | Majority | Minority |

| Executive Compensation | Performance-based | Performance-based | Mix of fixed and performance-based |

| Shareholder Rights | Strong | Moderate | Weak |

| CSR Reporting | Comprehensive | Moderate | Limited |

The table highlights that Flower Foods has a strong commitment to corporate governance, particularly in the area of independent directors and comprehensive CSR reporting. Competitor A generally mirrors these practices, while Competitor B may lag in certain areas, indicating that Flower Foods is positioned favorably in terms of governance and transparency.

Market Trends and Competitive Landscape: Flower Foods Investor Relations

Flower Foods operates within a dynamic food industry, subject to evolving consumer preferences, fluctuating supply chain dynamics, and intense competition. Understanding these market trends is crucial for the company’s strategic planning, operational efficiency, and sustained growth. This section provides an analysis of these key elements, detailing how Flower Foods navigates the challenges and leverages opportunities within this complex landscape.

Consumer Preferences and Changing Demands

Consumer preferences are constantly shifting, driven by factors such as health consciousness, convenience, and ethical considerations. This impacts the types of products consumers demand, and the channels through which they choose to purchase them.

- Health and Wellness: Consumers are increasingly prioritizing health and wellness, leading to a growing demand for products with lower sugar content, whole grains, and natural ingredients. Flower Foods responds by expanding its portfolio of better-for-you options. For example, the company has introduced whole-wheat versions of its popular breads and is exploring options with reduced sugar and added fiber.

- Convenience: The fast-paced lifestyle of many consumers fuels the demand for convenient food options. This includes ready-to-eat products, single-serve portions, and easy-to-prepare meals. Flower Foods caters to this demand through products such as individually wrapped snacks and pre-sliced breads, targeting on-the-go consumers.

- Sustainability and Ethical Sourcing: Consumers are becoming more aware of the environmental and social impact of their food choices. They are increasingly interested in products that are sustainably sourced, ethically produced, and packaged in eco-friendly materials. Flower Foods is addressing this through initiatives such as reducing packaging waste, sourcing ingredients responsibly, and supporting local farming communities.

- Flavor Exploration and Premiumization: Consumers are seeking more diverse and premium food experiences. This trend includes demand for artisanal products, unique flavor profiles, and high-quality ingredients. Flower Foods has responded by introducing premium bread lines with distinctive flavors and textures, catering to the evolving palates of consumers.

Supply Chain Challenges and Mitigation Strategies

The food industry is susceptible to various supply chain disruptions, including fluctuations in raw material prices, transportation bottlenecks, and labor shortages. These challenges can significantly impact profitability and operational efficiency.

- Commodity Price Volatility: The cost of key ingredients, such as wheat, sugar, and oil, can fluctuate significantly due to weather patterns, global demand, and geopolitical events. Flower Foods mitigates this risk through hedging strategies, long-term supply contracts, and diversification of its ingredient sourcing.

- Transportation and Logistics: Disruptions in transportation networks, including fuel price increases and driver shortages, can impact the timely delivery of products. Flower Foods addresses these challenges by optimizing its distribution network, utilizing multiple transportation providers, and investing in efficient logistics technologies.

- Labor Availability: The food industry often faces labor shortages, particularly in manufacturing and distribution roles. Flower Foods invests in employee training and development, offers competitive wages and benefits, and implements automation technologies to improve productivity and reduce labor dependency.

- Inflationary Pressures: Rising inflation across the economy impacts all aspects of the supply chain. Flower Foods combats inflation by focusing on operational efficiencies, optimizing product pricing strategies, and seeking out cost-effective sourcing opportunities.

Competitive Landscape and Strategies

The baked goods market is highly competitive, with a mix of national brands, regional players, and private-label products vying for market share. Flower Foods competes against these various players through its brand portfolio, distribution network, and operational efficiencies.

- Major Competitors: Key competitors include Bimbo Bakeries USA, Grupo Industrial Bimbo, and Hostess Brands. These companies have established brand recognition, extensive distribution networks, and diverse product portfolios.

- Competitor Strategies: Competitors employ various strategies, including aggressive pricing, new product innovation, targeted marketing campaigns, and strategic acquisitions. Bimbo Bakeries USA, for example, has a strong focus on product innovation and expanding its market presence through acquisitions. Hostess Brands focuses on a portfolio of iconic brands and leveraging its existing distribution network.

- Flower Foods’ Competitive Advantages: Flower Foods differentiates itself through its strong brand portfolio, extensive distribution network, and commitment to quality. Its diverse brand portfolio, including Nature’s Own, Dave’s Killer Bread, and Wonder Bread, allows it to cater to a wide range of consumer preferences. The company’s direct-store-delivery (DSD) system provides efficient product distribution and close relationships with retailers. Flower Foods emphasizes its commitment to quality ingredients, innovative product development, and sustainable practices.

- Addressing Competitive Pressures: Flower Foods addresses competitive pressures through strategic initiatives. This includes investing in brand marketing to build brand loyalty, developing new product offerings to meet evolving consumer demands, optimizing its supply chain for cost efficiency, and pursuing strategic acquisitions to expand its market reach and brand portfolio.

Capitalizing on Opportunities and Adapting to Market Changes

Flower Foods proactively seeks to capitalize on emerging opportunities and adapt to the dynamic changes in the food industry. The company focuses on innovation, strategic investments, and operational excellence.

- Innovation and New Product Development: Flower Foods continuously invests in research and development to create new and innovative products. This includes developing new flavors, formats, and ingredient combinations that meet evolving consumer preferences. An example is the introduction of new bread varieties with added protein and fiber, designed to appeal to health-conscious consumers.

- Strategic Acquisitions and Partnerships: Flower Foods actively evaluates strategic acquisitions and partnerships to expand its brand portfolio, enter new markets, and enhance its capabilities. The acquisition of Dave’s Killer Bread, for example, provided Flower Foods with a strong presence in the organic bread segment and expanded its market reach.

- Operational Efficiency and Cost Management: Flower Foods prioritizes operational efficiency and cost management to maintain its competitiveness. This includes investing in automation technologies, optimizing its supply chain, and implementing lean manufacturing practices.

- Digital Transformation and E-commerce: The company is investing in digital transformation to enhance its online presence, improve customer engagement, and streamline its operations. This includes developing e-commerce platforms, utilizing data analytics to improve decision-making, and leveraging digital marketing to reach consumers.

- Sustainability Initiatives: Flower Foods is committed to sustainability through various initiatives, including reducing its environmental footprint, sourcing ingredients responsibly, and promoting ethical business practices. The company’s sustainability efforts enhance its brand image and appeal to environmentally conscious consumers.

Future Outlook and Growth Strategies

Flower Foods, a prominent player in the baked goods industry, navigates a dynamic landscape shaped by evolving consumer preferences, competitive pressures, and economic fluctuations. Its future trajectory hinges on a multifaceted approach, encompassing strategic acquisitions, product innovation, and adaptation to changing market dynamics. This section explores Flower Foods’ long-term vision, the potential ramifications of its merger and acquisition (M&A) activities, and its responsiveness to shifts in consumer behavior.

Long-Term Growth Strategies

Flower Foods’ long-term growth strategies are anchored in a combination of organic expansion and strategic acquisitions, aiming to strengthen its market position and diversify its product portfolio. The company’s core strategies involve enhancing its existing brands, broadening its geographic reach, and innovating to meet evolving consumer needs.

- Brand Building and Portfolio Optimization: Flower Foods intends to strengthen its core brands like Nature’s Own, Dave’s Killer Bread, and Wonder Bread through targeted marketing initiatives and product innovation. This includes expanding into adjacent product categories and introducing new flavors and formulations to cater to diverse consumer tastes. For example, the introduction of organic and whole-grain varieties of its popular brands reflects a response to growing consumer demand for healthier options.

- Geographic Expansion: Flower Foods will continue to expand its distribution network, particularly in regions where it has a smaller presence. This includes leveraging its existing infrastructure to penetrate new markets and increase its market share. This strategy involves optimizing its supply chain and distribution channels to ensure efficient delivery of products to consumers.

- Operational Efficiency: Continuous improvement in operational efficiency is a key component of Flower Foods’ growth strategy. This includes streamlining its manufacturing processes, optimizing its supply chain, and leveraging technology to reduce costs and improve productivity. Initiatives such as automation and data analytics play a significant role in enhancing operational efficiency.

- Innovation and Product Development: The company is committed to investing in research and development to introduce new products and improve existing ones. This involves identifying emerging consumer trends and developing innovative baked goods that meet those needs. This may include products that are gluten-free, plant-based, or offer other health benefits.

Potential Impact of Mergers and Acquisitions

Mergers and acquisitions (M&A) play a significant role in Flower Foods’ growth strategy, providing opportunities to expand its product portfolio, enter new markets, and achieve economies of scale. However, M&A activities also involve inherent risks, requiring careful consideration and strategic execution.

- Portfolio Expansion: M&A allows Flower Foods to diversify its product offerings and enter new segments within the baked goods market. For instance, the acquisition of Dave’s Killer Bread significantly expanded the company’s presence in the organic bread category. This strategy enhances the company’s appeal to a broader consumer base.

- Market Entry and Expansion: Acquisitions can facilitate entry into new geographic markets or strengthen the company’s position in existing ones. Acquiring a regional bakery, for example, could provide access to distribution networks and customer relationships, accelerating market penetration.

- Synergies and Cost Efficiencies: M&A can create opportunities for synergies, such as consolidating manufacturing facilities, optimizing supply chains, and reducing administrative costs. This leads to improved profitability and efficiency.

- Integration Challenges: Integrating acquired businesses can be complex and challenging. This involves aligning different cultures, systems, and processes. Poor integration can lead to operational inefficiencies, loss of key personnel, and a decline in profitability.

- Financial Risk: M&A activities can involve significant financial risk, including high transaction costs, debt financing, and potential overpayment for acquired assets. Careful financial analysis and due diligence are crucial to mitigate these risks.

Adapting to Changing Consumer Behaviors

Consumer behavior is constantly evolving, driven by factors such as health consciousness, convenience, and sustainability concerns. Flower Foods is adapting to these changes through product innovation, marketing strategies, and supply chain adjustments.

- Health and Wellness: The growing demand for healthier food options has prompted Flower Foods to introduce products with reduced sugar, whole grains, and organic ingredients. The company’s focus on clean-label products and transparent ingredient sourcing reflects this trend. The launch of Dave’s Killer Bread, with its emphasis on organic ingredients and whole grains, exemplifies this adaptation.

- Convenience and On-the-Go Consumption: The increasing pace of modern life has fueled demand for convenient, ready-to-eat food options. Flower Foods is addressing this trend by offering single-serve products, grab-and-go options, and packaging designed for portability.

- Sustainability and Ethical Sourcing: Consumers are increasingly concerned about the environmental and social impact of the products they buy. Flower Foods is responding by focusing on sustainable sourcing practices, reducing its carbon footprint, and supporting local communities.

- Digital Engagement: Flower Foods is leveraging digital channels to engage with consumers, build brand awareness, and drive sales. This includes social media marketing, online advertising, and e-commerce initiatives.

- Personalization: The company is exploring opportunities to offer personalized products and experiences, such as customized bread options or subscription services, to cater to individual consumer preferences.

Risk Factors and Mitigation

Flower Foods, like any publicly traded company, faces a variety of risks that could impact its financial performance and overall success. These risks span across several areas, from market dynamics and supply chain vulnerabilities to regulatory changes and consumer preferences. Understanding and proactively managing these risks is crucial for the company to maintain its competitive edge and deliver value to its shareholders.

Flower Foods employs a multifaceted approach to mitigate these risks, incorporating strategic planning, operational improvements, and proactive monitoring.

Key Risk Factors

Several key risk factors can significantly affect Flower Foods’ operations and financial outcomes. These include, but are not limited to, commodity price fluctuations, supply chain disruptions, changes in consumer preferences, intense competition, and regulatory changes. These risks can manifest in various ways, from increased production costs and reduced profitability to diminished market share and reputational damage.

- Commodity Price Volatility: The cost of key ingredients, such as wheat, corn, and sugar, is subject to significant price fluctuations driven by weather patterns, global supply and demand, and geopolitical events. These fluctuations can directly impact Flower Foods’ cost of goods sold and overall profitability.

- Supply Chain Disruptions: Disruptions in the supply chain, whether due to natural disasters, transportation issues, labor disputes, or supplier failures, can hinder the company’s ability to produce and distribute its products efficiently. This can lead to production delays, increased costs, and lost sales.

- Changes in Consumer Preferences: Shifting consumer preferences towards healthier options, organic products, and alternative diets pose a risk to Flower Foods’ traditional product offerings. Failure to adapt to these evolving tastes can lead to declining sales and market share.

- Intense Competition: The packaged foods industry is highly competitive, with numerous players vying for market share. This competition can lead to pricing pressures, reduced margins, and the need for continuous innovation and marketing efforts.

- Regulatory Changes: Changes in food safety regulations, labeling requirements, or environmental regulations can increase compliance costs and potentially impact product formulations and packaging.

- Economic Downturns: Economic recessions can lead to reduced consumer spending, impacting sales volumes and profitability, as consumers may opt for cheaper alternatives or reduce discretionary spending on food products.

Mitigation Strategies

Flower Foods employs various strategies to mitigate the risks identified above. These strategies involve proactive planning, diversification, and continuous monitoring of market trends and operational performance. The company’s risk management approach is integrated throughout its operations, ensuring that potential threats are identified and addressed promptly.

- Hedging and Procurement Strategies: Flower Foods employs hedging strategies to mitigate the impact of commodity price volatility. This involves entering into futures contracts to lock in prices for key ingredients. Furthermore, the company diversifies its supplier base to reduce reliance on any single supplier and mitigate supply chain risks.

- Supply Chain Optimization: The company invests in optimizing its supply chain through technology, logistics improvements, and strategic partnerships. This includes monitoring supplier performance, diversifying transportation methods, and implementing robust inventory management systems.

- Product Innovation and Diversification: Flower Foods continuously invests in product innovation to meet evolving consumer preferences. This includes developing healthier options, expanding its organic product lines, and introducing new product formats to cater to different dietary needs and lifestyles.

- Brand Building and Marketing: The company focuses on building strong brands and implementing effective marketing strategies to differentiate its products in a competitive market. This includes targeted advertising, promotional campaigns, and digital marketing initiatives.

- Compliance and Risk Management: Flower Foods maintains robust compliance programs and actively monitors regulatory changes. The company works closely with regulatory agencies and invests in food safety and quality control measures to ensure compliance.

- Financial Flexibility: Flower Foods maintains a strong financial position with a focus on debt management and cash flow optimization. This financial flexibility allows the company to navigate economic downturns and invest in growth opportunities.

Example of Risk and Mitigation, Flower foods investor relations

Consider the risk of fluctuating wheat prices, a significant input cost for Flower Foods’ baking products.

Risk Factor: Volatility in wheat prices due to adverse weather conditions or global supply shortages, potentially increasing production costs and reducing profit margins.

Mitigation Strategy: Flower Foods utilizes a hedging strategy to mitigate the impact of wheat price fluctuations. This involves entering into futures contracts to lock in prices for a portion of its wheat needs. For example, if wheat prices are expected to rise, the company may purchase futures contracts to secure a predetermined price for a set quantity of wheat.This helps to stabilize production costs and protect profit margins, even if market prices increase. The company also maintains relationships with multiple wheat suppliers to ensure supply chain flexibility and mitigate risks associated with any single supplier.

Visual Communication and Presentation

Effective visual communication is paramount in investor relations, as it helps to convey complex information clearly and concisely. Flower Foods, like other publicly traded companies, relies heavily on visual aids in its presentations to investors, analysts, and the broader financial community. These visuals not only enhance understanding but also contribute to the overall impression of professionalism and transparency. The strategic use of visuals is a critical component of a successful investor relations strategy.

Visual Elements in Investor Presentations

Flower Foods’ investor presentations incorporate a variety of visual elements designed to engage the audience and effectively communicate key messages. These elements are chosen to align with the company’s brand identity and the specific goals of each presentation.

- Branding and Consistency: The presentations consistently use Flower Foods’ brand colors, fonts, and logo. This reinforces brand recognition and creates a cohesive visual identity across all investor communications. The use of a consistent visual style also conveys a sense of professionalism and attention to detail.

- Photography and Imagery: High-quality photographs and imagery are used to showcase the company’s products, facilities, and employees. For example, images of freshly baked bread, state-of-the-art bakeries, and smiling employees help to humanize the brand and connect with investors on an emotional level. These visuals support the narrative of quality, innovation, and a strong company culture.

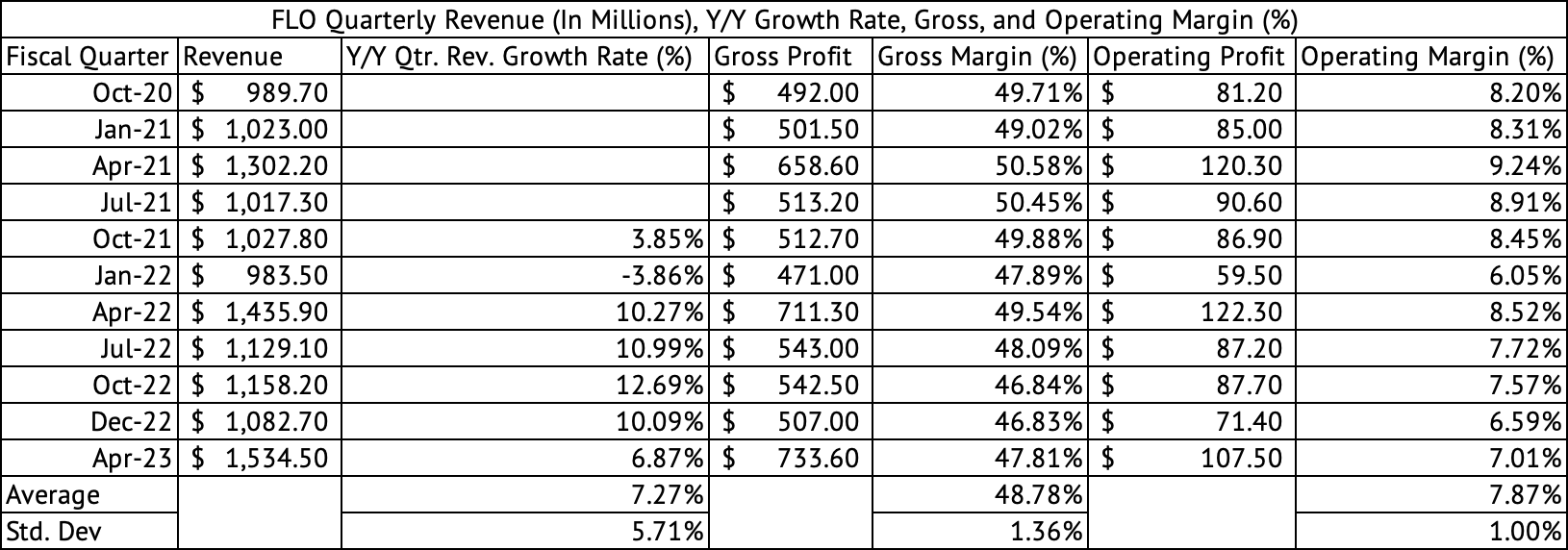

- Data Visualization: Charts and graphs are extensively used to present financial performance, market trends, and growth projections. These visualizations are designed to be clear, concise, and easily understandable, allowing investors to quickly grasp key data points and trends. The charts and graphs are often animated to guide the viewer through the data, highlighting significant changes and achievements.

- Animation and Transitions: Subtle animations and transitions are employed to enhance the flow of the presentation and maintain audience engagement. These effects are used sparingly to avoid distracting from the core message. For instance, data points may appear gradually on a chart, or key takeaways may be highlighted with a brief animation.

Charts and Graphs in Investor Relations Materials

The choice of charts and graphs in investor relations materials is critical for effectively communicating financial and operational performance. Flower Foods likely employs a range of chart types to visualize different types of data.

- Line Charts: Line charts are frequently used to display trends over time, such as revenue growth, net income, and stock price performance. These charts help investors quickly identify patterns and assess the company’s historical performance. For example, a line chart could illustrate the steady increase in sales over several years, demonstrating consistent growth.

- Bar Charts: Bar charts are used to compare different categories of data, such as sales by product category, geographic revenue breakdown, or expense allocation. These charts provide a clear visual comparison of different data points. For instance, a bar chart might compare the revenue generated by different brands within the Flower Foods portfolio.

- Pie Charts: Pie charts are used to show the proportions of a whole, such as market share or the distribution of costs. These charts provide a quick visual representation of the relative sizes of different components. For example, a pie chart might illustrate the company’s market share compared to its competitors.

- Area Charts: Area charts are used to show the cumulative values of data over time, emphasizing the magnitude of change. These charts are useful for visualizing the overall impact of various factors. For instance, an area chart could depict the growth of the company’s total assets over a period.

- Combination Charts: These charts combine different chart types to present multiple data points simultaneously. For example, a combination chart might show both revenue and operating margin over time, allowing investors to analyze the relationship between these two key metrics.

Descriptive Paragraph: Flower Foods Headquarters Image

Imagine a stately, modern building, likely the Flower Foods headquarters. The architecture is characterized by clean lines and a minimalist design, suggesting a focus on efficiency and innovation. The facade is predominantly glass and steel, reflecting a commitment to transparency and modernity. Large windows allow ample natural light to flood the interior, creating a bright and welcoming environment. The building is set amidst well-manicured landscaping, with neatly trimmed lawns and strategically placed trees, creating a professional and inviting atmosphere.

The overall impression is one of stability, growth, and a forward-thinking approach to business. The image likely communicates a sense of the company’s success and its commitment to its employees and the community.

Closing Summary

So, what have we learned today? We’ve witnessed how Flower Foods crafts its narrative, manages its finances, and engages with its shareholders. We’ve explored the landscape of corporate governance, the challenges of the market, and the exciting opportunities that lie ahead. We’ve seen how Flower Foods mitigates risks, communicates its vision, and ultimately, builds a relationship of trust with its investors.

Remember, understanding investor relations is more than just analyzing reports; it’s about appreciating the strategic decisions that shape a company’s future. Go forth and apply these insights to your own ventures, and remember that every great company has a compelling story to tell. Now go and make it happen!